To answer these questions, it is essential to place the market within a historical perspective. Beginning in the 1960s, the modern and contemporary art market started to take shape around a small number of influential galleries, prescriptive museums, and a still-limited group of institutional and private collectors, primarily concentrated in Europe and the United States. This was a relatively closed system, weakly financialized, with slow circulation of artworks.

The 1970s were marked by a cautious and sluggish market, affected by oil shocks, inflation, and broader economic instability. Art remained a niche market, characterized by moderate prices and low levels of speculation.

A major inflection point occurred in 1981, when the market entered a phase of unprecedented acceleration. It rapidly internationalized, the number of collectors multiplied, galleries proliferated, and New York asserted itself as the global epicenter, SoHo at the top end of the market and the East Village as an experimental laboratory. Paris and Europe retained a central role in the modern art market, while Latin America began to gain institutional visibility, albeit still peripherally. Prices surged: mere inclusion of a young artist in the Whitney Biennial could triple their market value. By the end of the decade, works by artists with still-fragile careers were trading between $100.000 and $200.000, in a seller-driven, highly speculative, and weakly regulated market.

This cycle came to an abrupt end in 1990, when the market collapsed following the simultaneous withdrawal of Japanese buyers, then central protagonists, amid Japan’s financial crisis. The downturn exposed an inflated and overvalued system. In 1991, some Sotheby’s sales recorded sequences of lots without a single bid. What followed was a period of correction, marked by greater caution, qualitative selectivity, and a renewed focus on historically established artists.

From 1995 onward, the market recovered gradually and episodically. Major auction houses globalized, international fairs multiplied, with Art Basel becoming the dominant model, and art increasingly came to be viewed as an alternative patrimonial asset. This cycle culminated just before the 2008 global financial crisis, when the collapse of Lehman Brothers brought the market to an almost complete standstill for several months and triggered an estimated 40% price correction.

After 2009, the market entered a new expansionary phase, fueled by global liquidity, the rise of collectors in Asia, the Middle East, and Latin America, and an increasing concentration of value in very top-tier lots. The 2010s were defined by successive records above $50 million and $100 million, the rise of mega-galleries, and an intense professionalization of the system.

Since May 2022, however, a new malaise has emerged. Rising interest rates, geopolitical tensions, reduced liquidity, and fatigue with an excessively speculative model have triggered another inflection point. The market has not collapsed, but it is reorganizing: major masterpieces have become scarcer, the ultra-high-end segment has lost momentum, the middle market has gained prominence, and collectors have adopted more cautious postures. The top of the market has become increasingly episodic, dependent on exceptional collections rather than on a continuous flow of record-breaking sales.

In 2025, this reconfiguration became even more evident. The number of transactions exceeded 40 million sales, with growth particularly visible in more accessible price brackets. In other words, the pie has shrunk, but circulation has increased. The market has moved away from reliance on a handful of stratospheric checks toward a broader, more diversified base of buyers, values, and categories.

This redistribution reveals a structural shift: less concentration at the top and greater dynamism in the middle and lower tiers of the pyramid. Growth in transaction volume does not reflect a weakening of interest in art, but rather the market’s adaptation to new consumption behaviors, collectors more risk-aware, more price-sensitive, and more inclined to build collections gradually. It is within this context that a more refined analysis becomes necessary: how sales are redistributed across value segments, how collector behavior is evolving, and how galleries, fairs, and auction houses are adapting their models to navigate this new market cycle.

The Weakening of the Top of the Pyramid ($10M+)

It is precisely at the top of the pyramid that this inflection is most dramatic. The segment of sales above $10 million has consistently lost momentum: transactions in this range fell by approximately 44% compared to 2024, and no artwork above $50 million was sold in the first half of 2025, according to Bank of America Private Bank data. At the same time, the Art Basel & UBS Art Market Report identifies the $10 million-plus segment as the system’s greatest “brake,” with double-digit declines in both value and volume, and growing difficulty for auction houses in securing truly exceptional consignments. This does not mean that desire for art has disappeared; rather, risk appetite at this price level has changed.

The top of the art market has not vanished; it has narrowed. Between 2022 and 2025, it has become rarer, more spectacular, and increasingly curatorial in nature, driven less by volume than by moments of exceptional concentration. Today’s highest prices are no longer sustained by a continuous flow of trophy lots, but by singular events defined by impeccable provenance, strong museological narratives, and carefully engineered sale conditions, often operating at the frontier between public auctions and highly structured private transactions.

In 2022, at the apex of the previous market cycle, the Paul G. Allen Collection embodied a model that now appears almost irreproducible. The single-owner sale achieved $1.62 billion, combining extraordinary breadth, institutional-level quality, and immediate liquidity. Within that context of abundance, multiple works surpassed the $100 million threshold, including Paul Cézanne’s La Montagne Sainte-Victoire, which sold for $137.8 million. Such density of ultra-high-value results reflected a market still capable of absorbing repeated nine-figure prices within a single season, an outcome that would be unthinkable in today’s environment.

As the cycle turned, the architecture of the top market shifted. By 2024 and 2025, supply tightened dramatically, buyer selectivity intensified, and the pool of truly committed bidders narrowed. Yet this contraction did not eliminate the top of the market; it transformed it. The sale of Pauline Karpidas’s Surrealist Collection in London offers a telling example. Estimated at $53 million, the collection ultimately achieved $100 million, with a 100% sell-through rate, marking a historic moment for the London market. The result underscored a key trend: when curatorial coherence, rarity, and narrative alignment converge, liquidity can still materialize decisively, even outside the traditional blockbuster evening-sale model.

This evolution reached its most emblematic expression in 2025 with the sale of the Leonard A. Lauder Collection at Sotheby’s. Valued at approximately $400 million, the collection achieved $527.5 million in the main session alone, propelling a historic evening totaling $706 million. The sale demonstrated that while the steady circulation of $50 million-plus works has largely dried up, moments of extraordinary concentration remain possible when supply, provenance, and institutional relevance align perfectly.

The evening was dominated by the monumental record set by Gustav Klimt’s Portrait of Elisabeth Lederer, sold for $236.4 million, becoming the most expensive modern artwork ever auctioned and the second most expensive work in auction history. Around it gravitated a small constellation of equally emblematic results: Claude Monet reaffirmed his status as a safe haven with Nymphéas en fleur, 1914–1917, sold for $84.6 million; Vincent van Gogh’s Parisian Novels achieved $62.7 million; and Frida Kahlo’s El sueño reached $54.66 million. In each case, the common denominator is not merely the artist’s name, but the rare convergence of museological quality, extreme scarcity, and the ability of a single work, or a coherent collection, to create a concentrated, almost ritualized market moment in which the top reasserts itself with full force.

Scarcity of Works and New Sales-Generation Strategies

Analyses based exclusively on public data now offer a partial, and often distorted, view of the art market. Auction reports highlight percentage declines in sales, but overlook a substantial share of transactions taking place off-market, where works are quietly negotiated through private channels beyond public visibility. In both the primary market and the private secondary market, gallery transactions and direct private sales, whether between collectors or through dealers, remain largely opaque, with no systematic disclosure of prices, volumes, or actual margins. The coverage conducted by Sophie Su Art Advisory at major international fairs aims precisely to mitigate this informational gap, at least with regard to the Brazilian art market, by functioning as a real-time barometer of private sales dynamics.

Throughout this year, we have consistently observed that market contraction has been particularly pronounced in the high-value segment, mirroring performance at major international fairs. For this reason, it is no longer possible to base analysis solely on public data or on narratives disseminated by parts of the specialized press, which often lack full independence and tend to reiterate the idea of a “heated market,” without access to a substantial portion of the behind-the-scenes information that actually shapes market dynamics.

At the same time, a decisive structural factor behind the global market slowdown is not demand-driven, but supply-related: major collectors are increasingly choosing to retain their masterpieces. Bank of America data show an approximately 14% year-on-year increase in art-backed lending in the first half of 2025, as collectors leverage their holdings as collateral to access liquidity without selling. This mechanism, once marginal, has become central. Some galleries and private dealers now specialize in providing loans secured against clients’ artworks, effectively offering a form of art-backed mortgage in exchange for short-term liquidity to finance new acquisitions.

In parallel, the share of guaranteed lots in evening sales of modern and contemporary art reached 45.5%, accounting for 73% of total value sold, the highest level ever recorded. In absolute terms, this represents an estimated $10 billion in guaranteed sales worldwide in 2025, across more than 2.300 lots, underscoring the scale this mechanism has now reached at the very top of the market. This figure alone signals a profound transformation in how auctions function today. Once conceived as slow, competitive price-discovery mechanisms, requiring long lead times to assemble sales of sufficient caliber, major auctions have increasingly become quasi–private treaty transactions in advance. Guarantees have emerged as the decisive tool enabling auction houses to secure masterpieces; without them, many sellers are no longer willing to assume market risk.

The result is a highly protected, pre-structured, and pre-negotiated top market, far removed from the spontaneous or openly competitive auction environment of a decade ago. This system has also evolved into a full-fledged business model for guarantors most often mega-galleries and major dealers, for whom guarantee fees and upside participation now represent, in some cases, more than half of their annual profits.

Within this context of asset protection and risk containment, auction houses have increasingly prioritized sell-through rates, often exceeding 90%, by adopting deliberately conservative estimates, in many cases set at less than half of prevailing primary-market prices. While this strategy aims to stimulate competition and generate stronger results, hammer prices in practice have clustered near low estimates, establishing public benchmarks below real market levels and fueling growing distrust around primary-market price formation.

Meanwhile, collector behavior has undergone a structural transformation. Information overload, the multiplication of fairs, galleries, and artists, contrasted with a far more limited system in the past, has produced a paradoxical effect: instead of increasing appetite, it has generated saturation. Time has become a scarce resource, and purchasing decisions are now more selective, less impulsive, and heavily based on trust. Acquisitions increasingly occur through affinity, credibility, and qualified advisory relationships, as well as through highly specific, curated experiences provided by the market agents, rather than through accumulation or dispersion. In this context, the logic of ownership is progressively giving way to the logic of experience: private access, meaningful encounters, and singular moments now outweigh the symbolic appeal of luxury objects alone. More than ever, value lies not in abundance, but in discernment.

The New Engine of the Market: Volume, Accessibility, and New Buyer Profiles

In 2024–2025, market dynamism clearly originates from the base and the middle of the pyramid. Works priced below $10 million recorded growth of approximately 17% in both volume and number of transactions, while the segment below $5.000 gained further relevance, reflecting greater accessibility and the incorporation of new buyers into the system.

HNWIs survey data reveal a reality often obscured by average figures. While average annual spending per collector in 2024 reached approximately $438.990, across an average of 14 works, the median shows what a “typical” collector spends in a year: 50% spend less than $24.000 and 50% spend more, unlike the average, which can be distorted by a few extremely large purchases. This level remained virtually stable between 2024 and 2025, indicating that, despite macroeconomic turbulence, the level of spending by collectors did not undergo significant variations during that period.

This median figure largely reflects the purchasing behavior of Millennial and Gen Z collectors, who focus on more accessible price ranges and higher purchase frequency. Fully 64% of collectors spent less than $50.000 on art and antiques. In other words, the market now moves from the bottom up: while traditional buyers slow down, a broader, younger, more global, and more digital base sustains transaction volume and reshapes market dynamics.

This new cycle, driven primarily by Millennials and Gen Z, is notable not only for purchasing volume but also for openness to discovery. In 2024, 66% of HNWIs acquired works by newly discovered artists, the highest level ever recorded. Importantly, “newly discovered” does not necessarily mean young or emerging artists, but rather creators newly integrated into a collector’s personal repertoire, even if they are already established or top-tier.

This openness varies regionally, from 36% in China to 84% in France, and is particularly pronounced among Millennials, 71% of whom purchased newly discovered artists. At the same time, risk behavior has evolved: throughout 2024 and the first half of 2025, most capital flowed toward established artists, who accounted for 44% of total spending, while new and emerging artists represented 35%, below levels seen in previous years. Curiosity and renewal now coexist with greater selectivity and anchoring in consolidated names.

This structural shift helps explain the apparent paradox observed in recent auction data. Based on international auction results for 2025 compared to 2024, the ultra-contemporary segment shows the steepest decline in value, with contractions exceeding 30% across certain metrics. However, this reading must be carefully contextualized. Auction results have become an increasingly imperfect proxy for ultra-contemporary, and, to some extent, younger contemporary, markets as a whole.

Rather than signaling a collapse in demand, the decline reflects a reconfiguration of transactional channels. New collectors, particularly first-time buyers and younger participants, continue to actively acquire contemporary and ultra-contemporary works, but increasingly through galleries, studios, and primary-market relationships, rather than via auctions. Moreover, 2023 and 2024 were marked by intense speculative dynamics in this segment, with inflated results frequently supported by guarantees, cross-buying, and market-support mechanisms. The current correction is therefore less an indicator of structural weakness than a post-speculative normalization, aligning prices more closely with underlying demand.

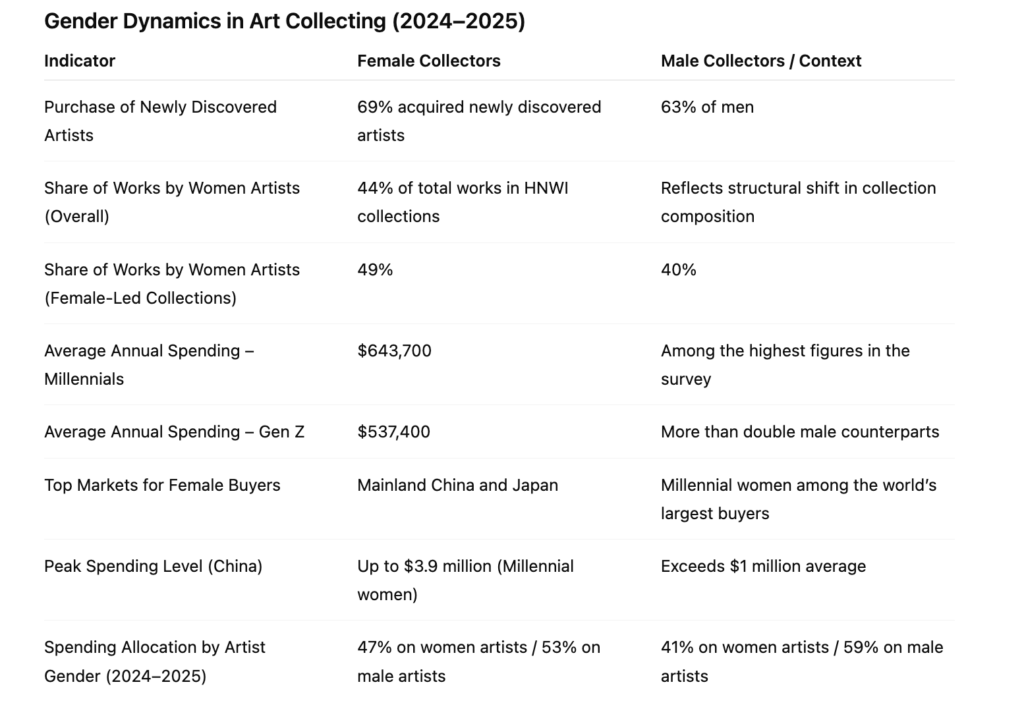

The gender dimension is even more revealing. Female collectors not only purchase more newly discovered artists (69% versus 63% of men), but are increasingly central to the market. Works by women artists already represent 44% of total collections (up from 33% in 2018), rising to 49% within female-led collections, compared with 40% in collections led by men, which remain more heavily dominated by male artists.

Spending patterns reinforce this shift. In 2024/2025, women allocated 47% of their art spending to works by female artists and 53% to works by male artists, while men devoted 41% of their spending to female artists and 59% to male artists. Generational differences further accentuate this trend: Gen Z collectors spent 45% of their budgets on works by women artists (and 55% on male artists), compared with just 25% among boomers (and 75% on male artists).

In spending terms, women also lead among younger collectors overall. Millennial women reported average annual spending of $643.700, one of the highest figures in the survey, while Gen Z women averaged $537.400, more than double their male counterparts. In markets such as mainland China and Japan, Millennial women rank among the world’s largest buyers, with averages exceeding $1 million, reaching $3.9 million in China. As wealth shifts both vertically and horizontally across generations and geographies, these dynamics are likely to foster greater gender balance and diversity in future collections.

In transaction volume, younger collectors are also the most active. Gen Z collectors averaged 21 acquisitions per year, surpassing all other generations, with young women leading this trend. Millennials and Gen X display similar patterns, while among Boomers, women remain more active than men in terms of number of purchases.

Generation X (Gen X)

Born: approximately 1965 to 1980

Age in 2025: roughly 45 to 60 years old

Millennials (Generation Y)

Born: approximately 1981 to 1996

Age in 2025: roughly 29 to 44 years old

Generation Z (Gen Z)

Born: approximately 1997 to 2012

Age in 2025: roughly 13 to 28 years old

*The survey is the 12th in a series conducted in collaboration with Arts Economics and UBS. It now covers 10 markets, with responses from 3,100 HNWIs, including 1,575 women, and remains one of the largest surveys of high-net-worth collectors globally.

Ecosystem Reorganization: Gallery Closures and Fair Model Adjustments

Before manifesting at major international fairs, market reconfiguration had already become visible—more quietly but just as decisively—within the gallery ecosystem itself. In 2024–2025, the closure of influential spaces such as Blum (Los Angeles), Rhona Hoffman (Chicago), Peres Projects (Berlin), Kasmin, Venus Over Manhattan, and CLEARING all in New York exposed the growing exhaustion of a model that had sustained decades of primary-market expansion. This contraction was mirrored by strategic withdrawals from key international hubs: Tanya Bonakdar Gallery closed its Los Angeles space, Pace and Perrotin exited Hong Kong, and Almine Rech shut its London gallery, signaling a recalibration of global footprints rather than isolated failures.

Even more significant, yet far less visible in mainstream coverage, is the disappearance of approximately 60 young galleries over the past four years, particularly in hubs such as New York’s Lower East Side. Historically, these spaces function as experimental laboratories, launching new languages, emerging artists, and trends later absorbed by institutional and commercial circuits. As recent critical analyses have emphasized, their loss represents not only economic contraction but cultural impoverishment, as these galleries bear the greatest symbolic and curatorial risk.

Against this backdrop, the reorganization of fairs should be understood not as a cause, but as a consequence. Art Basel Miami Beach, for example, lost several traditional exhibitors from its main sector, including Miguel Abreu, Chantal Crousel, Alison Jacques, and Luisa Strina. In many cases, these absences reflect strategic choices rather than financial distress. Several galleries have opted to prioritize Frieze Masters and Art Basel Paris, avoiding the logistical, human, and financial marathon of three major fairs in the same semester.

Participation fees have risen arbitrarily, without proportional increases in cultural or economic value. In practice, fairs absorb a significant share of galleries’ financial resources, often at the expense of permanent spaces, long-term programming, and sustained work with artists. What was once designed to amplify visibility has, in many cases, begun to undermine the very structures that produce meaning and continuity.

At the same time, participation rules have become more rigid, with clauses requiring payment of 50% to 100% of fees in cases of late withdrawal, increasing operational risk for exhibitors. This inflation in participation costs has pushed galleries into a defensive posture. Faced with financial pressure, they increasingly present what sells fastest rather than what is most relevant. The result is a recurring selection of “easy-to-sell” works, often derivative, repetitive, and conceptually diluted. Over time, this standardization has generated growing visual and intellectual fatigue among both professionals and collectors.

Still, the presence of 19 new galleries in the main sector signals an ongoing process of reorganization and client acquisition by fairs, adjusting scale, expectations, and priorities. Yet with projections of further slowdown in 2026, a sensitive question arises: to what extent might this reconfiguration lead to greater flexibility in selection criteria, opening space for less rigorous curatorial proposals, already observed this year in certain segments of Design Miami? The challenge will be to preserve relevance and curatorial rigor in an environment under pressure from costs, competition, and reduced risk appetite.

At the operational level, the shift toward a hybrid physical-digital model may be the most lasting transformation. Online sales now account for approximately 22% of the market, slightly down from 2023, but with a significant qualitative shift: sales via galleries’ own websites have more than doubled since 2019, reflecting investments in digital infrastructure and growing buyer confidence. Fairs reaffirm their role as spaces of encounter, validation, and experience, while social networks, particularly Instagram, have become central channels for discovery and, increasingly, direct purchase. In HNWI surveys covering 2024 and the first half of 2025, 83% of collectors reported purchasing through galleries, across physical spaces, online platforms, fairs, and social media, and more than half of those buyers acknowledged having made at least one Instagram purchase without seeing the work in person.

What emerges is a market that is less euphoric and more strategic, less obsessed with immediate trophy pieces and more attentive to coherence, quality, and context. For collectors and institutions alike, this opens an opportunity, and a responsibility, to build more solid collections, with deeper narratives and genuine diversity of voices, geographies, and media.

A Market Geography Turning Eastward and Toward the Global South

Meanwhile, the geographic map of the market is being quietly but structurally redrawn. The Middle East has consolidated itself as one of the most closely watched regions in the global system, with Christie’s and Sotheby’s launching auctions in Saudi Arabia and Art Basel preparing its Doha edition. Within this same horizon, Frieze announced the launch of Frieze Abu Dhabi, scheduled for November 2026, taking over the Abu Dhabi Art platform and reinforcing the region’s ambition to position itself as a central hub within the international fair circuit. This movement is not episodic: it is anchored in over a decade of strategic investment in cultural infrastructure, from the Louvre Abu Dhabi to the AlUla Arts Festival, and accompanied by clear signs of HNWI migration from London to Dubai and Abu Dhabi, driven by more favorable tax regimes and a rapidly maturing cultural ecosystem.

In parallel, Milan is gaining prominence through the arrival of international galleries and the strengthening of a locally rooted collector class, developments directly linked to a more competitive fiscal environment with attractive tax regimes for large fortunes. This contrasts sharply with countries such as the United Kingdom, which have pursued higher taxation of high-net-worth individuals, accelerating the relocation of collectors, capital, and operational structures to other European centers.

Among the four major global hubs, France stands out as the only market in growth in the first half of 2025, with an increase of 4.7% and approximately $363.9 million in sales, while the United States and China declined, confirming that market centrality has become less fixed and increasingly polycentric.

This geographic redistribution directly intersects with a profound shift in curatorial outlook and collector behavior. Scarcity of top-tier works, combined with fatigue toward overly reiterated narratives from the US–Europe axis, opens space for a renewed valuation of the Global South. Biennials and major institutional exhibitions have been key catalysts in this process.

Beyond the Venice Biennale and the São Paulo Biennial, both revisiting local modernist genealogies and expanded political narratives, the role of these platforms has evolved significantly. In 2024, under the curatorship of Adriano Pedrosa, the Venice Biennale marked a decisive moment in this shift by centering Latin American, Afro-descendant, and Indigenous artists long excluded from the Western canon, reinforcing a curatorial turn toward historical repair, plurality, and epistemic rebalancing. More recently, platforms emerging outside the traditional Euro-Atlantic circuit have gained renewed visibility and strategic relevance. The launch of the Bukhara Biennial in Uzbekistan signals a clear institutional effort to reinscribe Central Asia into the symbolic geography of contemporary art. In Latin America, the creation of the Bienal das Amazônias, whose second edition will take place in Belém in 2025, reflects a curatorial shift toward ecological, territorial, and Indigenous epistemologies rooted in the Global South.

At the same time, longer-standing initiatives have acquired new resonance within this reconfigured landscape. Bienal Sur, active across multiple locations in South America, including Colombia, proposes a decentralized, transnational model that challenges the traditional biennial format. Within this broader context, collectors increasingly express a desire for research, discovery, and critical depth: less consumption of ready-made trends, and more engagement in the construction of meaning, narrative, and long-term legacy.

For decades, social pressure has discouraged collectors from openly questioning the art market. Over time, this dynamic has produced a system in which silence is rewarded, dissent discouraged, and critical judgment gradually suspended. In such an unchallenged environment, the role of art criticism itself has eroded: independent critical voices have largely disappeared, replaced by trend-driven commentary and speculative narratives that often legitimize unjustified price inflation around certain artists. Publicly questioning a purchase now risks not only reputational loss, but also the symbolic devaluation of a collector’s own collection, reinforcing self-censorship and collective conformity. Within this context, art media has increasingly failed to fulfill its corrective role. Large segments of art journalism recycle narratives of resilience and growth that do not withstand close scrutiny.

This distortion is structural rather than incidental. Media outlets remain financially and operationally dependent on the same dominant investors, galleries, auction houses, and sponsors who shape prices, visibility, and access. As a result, information is managed, softened, or strategically framed. The market is declared “strong” not because it is, but because it must be.

This structural fragility is most visible in the fair system itself. As fairs proliferate and costs escalate, they impose an increasingly accelerated mode of viewing: thousands of works compressed into a few hours, across tightly scheduled, interchangeable formats. Time, the very condition required for understanding, context, and discernment, is systematically stripped away. What follows is a rapid, cursory, and largely uncritical consumption of art. Under these conditions, exhibitions, fairs, and biennials begin to collapse into variations of the same template, the now-familiar “usual boring fair.” Difference is flattened, risk discouraged, and repetition mistaken for coherence. Yet despite how widely this fatigue is felt, it remains largely unspoken. Dependence on the fair system, for sales, visibility, and institutional validation continues to silence open criticism. Dissatisfaction circulates privately, while the public narrative remains carefully maintained.

It is precisely within this tension that a shift is taking place. Those most attuned to the ecosystem, artists, advisors, collectors, and informed insiders are increasingly aware of the limits of the speculative behaviors that defined the post-2020 cycle. In response, they are seeking alternative modes of engagement. Today, the highest form of achievement in the art world is no longer short-term financial gain, but the gradual accumulation of social, cultural, and intellectual capital.

This shift mirrors a broader transformation in ultra-high-net-worth behavior. While prices for ultra-luxury goods have declined since 2023, spending on exceptional experiences has surged—rising by nearly 90% since 2019, according to the Economist study. Access itself has become the true marker of value: attending events such as the Met Gala now costs more than twice what it did in 2019. Objects remain purchasable; experiences, by contrast, are scarce, selective, and non-replicable.

Anyone can acquire a painting. Far fewer can access the knowledge, proximity, and long-term relationships required to meaningfully accompany an artist or a gallery to support, advise, and actively cultivate a practice over time. Supporting an artist before recognition, standing beside them when no one is watching, and remaining committed as their work develops is a rare privilege. It is this sustained involvement, more than market timing, that ultimately leads to institutional validation. When a work enters a museum or public collection, that moment, not resale, becomes the true dividend. For a growing generation of collectors, the real reward lies in the satisfaction of having helped shape a life, a trajectory, and a legacy, perhaps even a chapter of art history itself.

This renewed appreciation for time, discretion, and selective presence marks a move away from hyperactivity and hyperconsumption, toward a quieter form of value creation rooted in attention and responsibility. This transition from speculation to stewardship is neither sentimental nor ideological. It is a structural correction and possibly the only viable path toward a healthier, more credible, and more sustainable art market.

As Sophie Su Art Advisory prepares its next chapter for 2026, we would like to deepen the dialogue with the community that has shaped this work. We have created a short survey (2–5 minutes) to better understand your interests, collecting practices, and how our analyses and initiatives support your engagement with the art world. Your perspective will help us refine the way we accompany you, through sharper insights, bespoke advisory, and meaningful encounters. We would be grateful if you could take a moment to complete the survey via the button below.