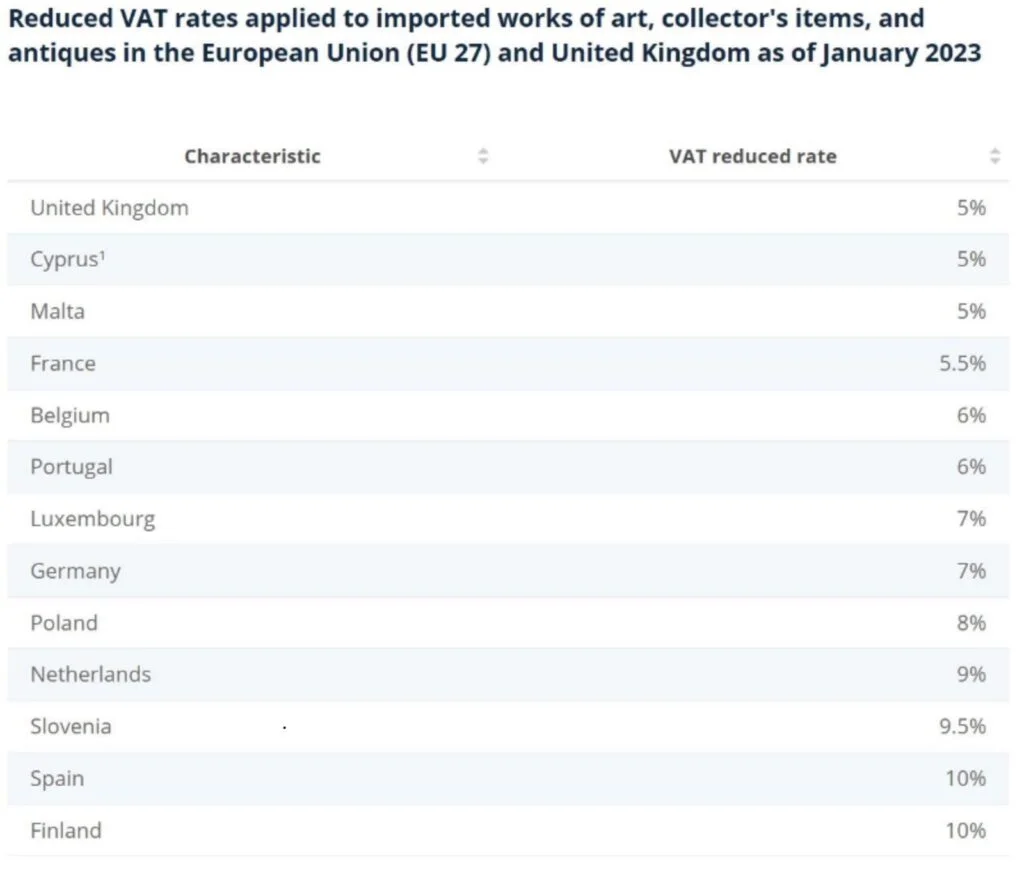

Countries are required to align national laws with the new directive by the end of 2024. The previous directive passed in 2006 excluded art from the list of products and services eligible for reduced VAT rates. But this new directive includes a “supply of works of art, collectors’ items and antiques”! Gallerists and art dealers see this as an unprecedented opportunity to establish or re-establish a reduced VAT rate for art.

In Italy, the government is willing to reduce the rate of VAT on imports of works of art from countries outside the common market to 5.5%, the same rate as in France.

In Germany, dealers see an opportunity to reduce VAT for national galleries to 7%, instead of the current 19%, which they say is crippling the market.

In France, gallery owners and art dealers, among others, fear an increase in VAT on works of art following another directive from the Council of the European Union (EU), which should raise VAT from the current 5.5% (French exception) to 20% on the sale of works of art and their importation from third countries. With the new directive, however, this could be countered. “The government will probably make a decision this year. They don’t want galleries to leave France and go to London,” said Gaëlle de Saint Pierre, a tax expert at France’s Comité Professionnel des Galeries d’Art to The Art Newspaper.

It should be noted that France, with its current rate of 5.5% for works of art, has been the gateway to Europe for the art market since Brexit.

In London, since Brexit, a buyer has had to pay a tax on reimporting to another European country. Add to that the cost of transport and it becomes very expensive. As a result, major auction houses such as Christie’s and Sotheby’s are currently reviewing the profitability of keeping certain departments in London in favor of cities with a strong local market.

Paris is also a very attractive city for collectors, thanks to its rich and dynamic cultural program, its gastronomy, its luxury hotels and the various events that take place throughout the year, such as Fashion Week and Paris+ by Art Basel. Collectors are looking for more than only an acquisition, they are looking for a global experience like the one Paris offers.

A reduced VAT rate for art helps to boost national markets, which are often crushed by competitors country with lower rates. For example, the current rate of 5.5% makes France the preferred gateway for importing works into Europe. The country ranks fourth in the world behind the United States, China, and the United Kingdom, with 7% of the total cumulative sales of works of art in 2021 (compared to 3% in 2001) and represents about 50% of the art market in the EU.

Brazil has a highly protectionist – and dissuasive – system under which a national buyer would have to pay an import tax equal to 50% of the cost price to repatriate the masterpiece.

There has been an attempt of a law proposal in 2003 (article 1, PEC number 74) to change the tax on (re)imports of works of art by Brazilian artists, even if produced abroad, and by foreign artists dealing with Brazilian themes. The amendment aims to prevent federal and state tax authorities from continuing to tax the importation of cultural goods according to import taxes related to the movement and the provision of interstate transport as well as communication services.

This would encourage the importation of works of art into Brazil and thus revive the Brazilian art market, but this won’t be the case as the law project has not been adopted. It should be noted that currently any artwork produced outside Brazilian territory, even by a Brazilian artist, it is being taxed in case of reimportation to its country of origin…

The rate of VAT on artworks affects the attractiveness of a centre in the art market. For gallery owners, art dealers and other actors in the art world, it is vital that their country supports them, in particular with laws that favour the import, export and sale of works of art.