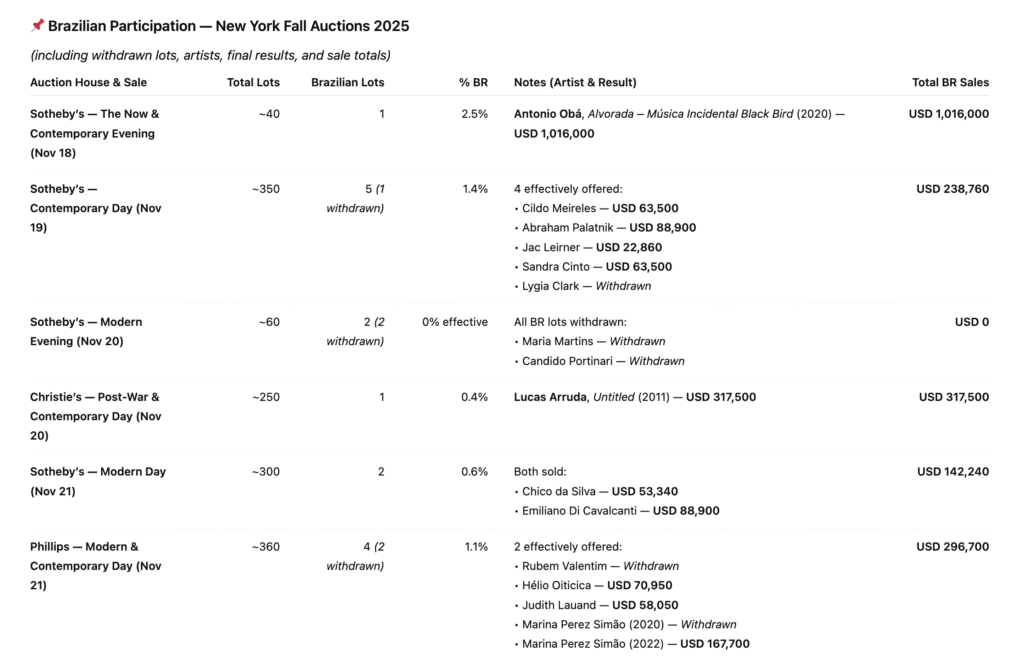

We observed very few Brazilian artists represented this season, revealing a clearer picture of where liquidity truly lies. On one hand, contemporary Brazilian artists with established international visibility achieved steady and competitive results, confirming market confidence and liquidity. On the other, the season exposed a persistent structural issue: the strategic withdrawal of five historically significant Brazilian lots, which not only affected statistical representation but also underscored the ongoing challenges faced by historical Brazilian art in the international market challenges often tied to rarity, limited circulation, prohibitive national import taxes, and complex provenance requirements.

Sothebys

The Now & Contemporary Evening Auction

18 November 2025 | 19:00 EST

The outstanding result of Antonio Obá’s Alvorada – Música Incidental Black Bird, 2020 at Sotheby’s, surpassing $1 million, does not emerge in isolation. It consolidates a trajectory of remarkable auction performance over the past two years, consistently driven by mid-scale paintings of strong technical rigor and symbolic density. Works such as Sankofa – Figura com Alpargata, 2020, sold for $228.600 at Sotheby’s New York (May 2024), and a paint from 2019, sold for $165.551 at Christie’s London Evening Sale (October 2024), illustrate this sustained demand.

The November 2025 result, however, introduces a rare market inflection: the appearance of a large-scale painting, a format that is almost impossible to access through private market channels, given the institutional interest and the artist’s growing presence in public collections, including the Museo Reina Sofía, ICA Miami, Inhotim, Marciano Foundation, KADIST, and Fondazione Sandretto Re Rebaudengo, among others. The exceptionally attractive estimate at Sotheby’s, well below Obá’s current market reality, generated a context of competition rarely available to collectors, fueling a result that positioned the artist among the top auction records for Brazilian artists in recent history.

In parallel, Obá’s expanding institutional visibility, exemplified by the traveling exhibition Finca-Pé: Estórias da Terra, premiered in Rio de Janeiro, followed by Belo Horizonte, and currently at CCBB Brasília, reinforces why large works are increasingly retained by museums and curators, rather than entering the market. The convergence between scarcity, institutional anchoring and symbolic potency thus explains not only the record result, but the strategic rise of Obá as one of the most consequential and competitive Brazilian artists in the global auction landscape today.

Antonio Obá

Alvorada – Música Incidental Black Bird, 2020

Oil on canvas

178 x 205 cm

Estimate: $100.000 – $150.000

Sold: 1.016.000

Contemporary Day Auction

19 November 2025 | 10:00 EST

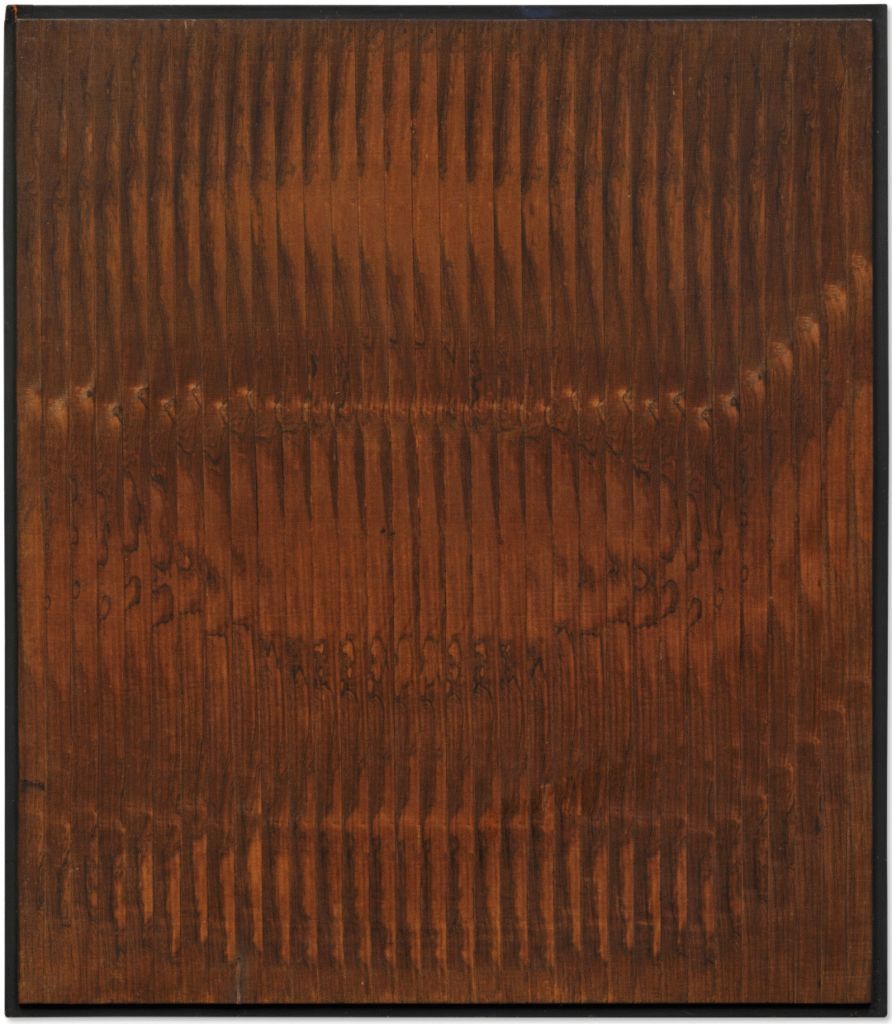

Abraham Palatnik, Progressão HO-A, 1965, sold for $88.900. This work stands apart within Palatnik’s market: it is an early, historic piece, executed on jacarandá, and not one of the more commercially circulated kinetic works that typically appear at auction. Palatnik is represented by Galeria Nara Roesler, which maintains a strong presence in New York (Chelsea) and regularly places high-quality works by the artist in institutional and private collections. Within this context, the hammer price was strikingly attractive, considering both the artist’s historical importance and the rarity of early works of this caliber entering the market. In other words, this was a significant artwork that sold at a comparatively modest price point, especially given Palatnik’s established position within global post-war abstraction.

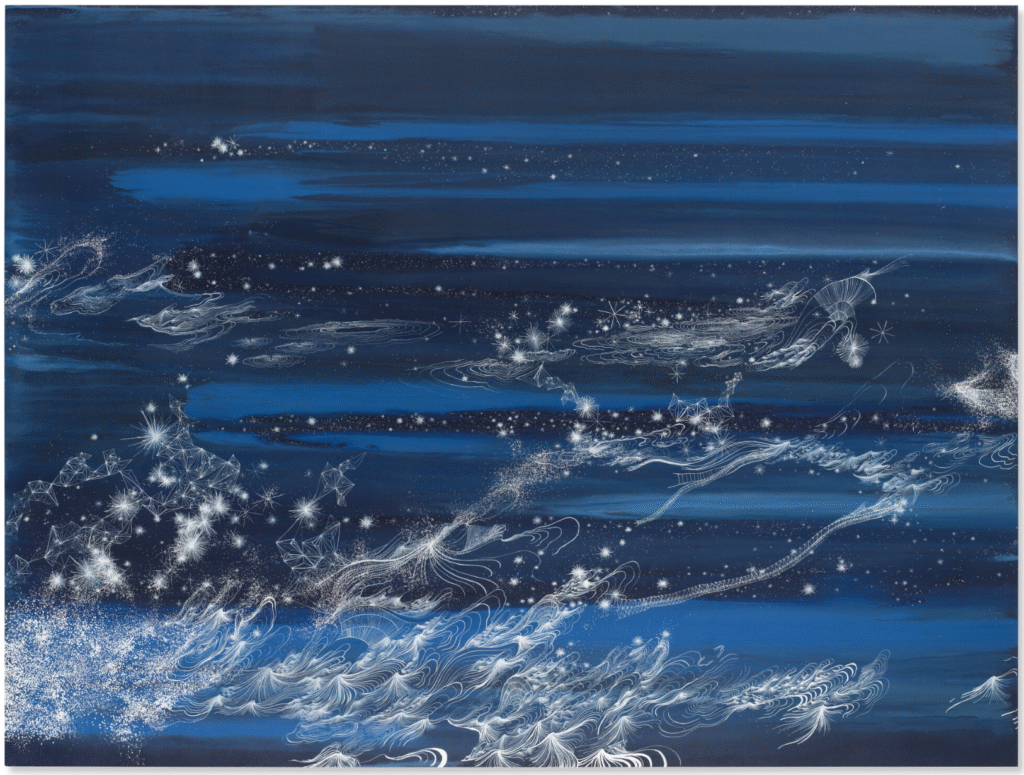

Sandra Cinto’s appearance at Sotheby’s this season must be understood in light of her current institutional momentum. She is presently featured in a major solo project at Es Baluard Museu d’Art Contemporani de Palma, where “Prelude for the Sun and the Stars” transforms the space into an immersive cartography of water, time and celestial landscape, reinforcing her vocabulary of drawing as emotional architecture.

Represented by Tania Bonakdar Gallery (New York / Los Angeles) internationally, Cinto has increasingly placed monumental works in significant international collections. Her return to the auction market comes nearly ten years after her last international sales in 2015, when smaller, less representative works traded at values far below her current standing. The Sotheby’s result, although modest, marks the first time a work of this scale and symbolic impact is offered in a major global auction, signaling her transition from institutional acclaim to meaningful market recognition.

Meanwhile, the presence of Jac Leirner, represented internationally by Regen Projects, and Cildo Meireles, represented internationally by Galerie Lelong, underscores that even well-established conceptual and historical figures depend on strategic institutional platforms to sustain market visibility, a factor that partially explains why their results, this season, reflected selective rather than speculative demand.

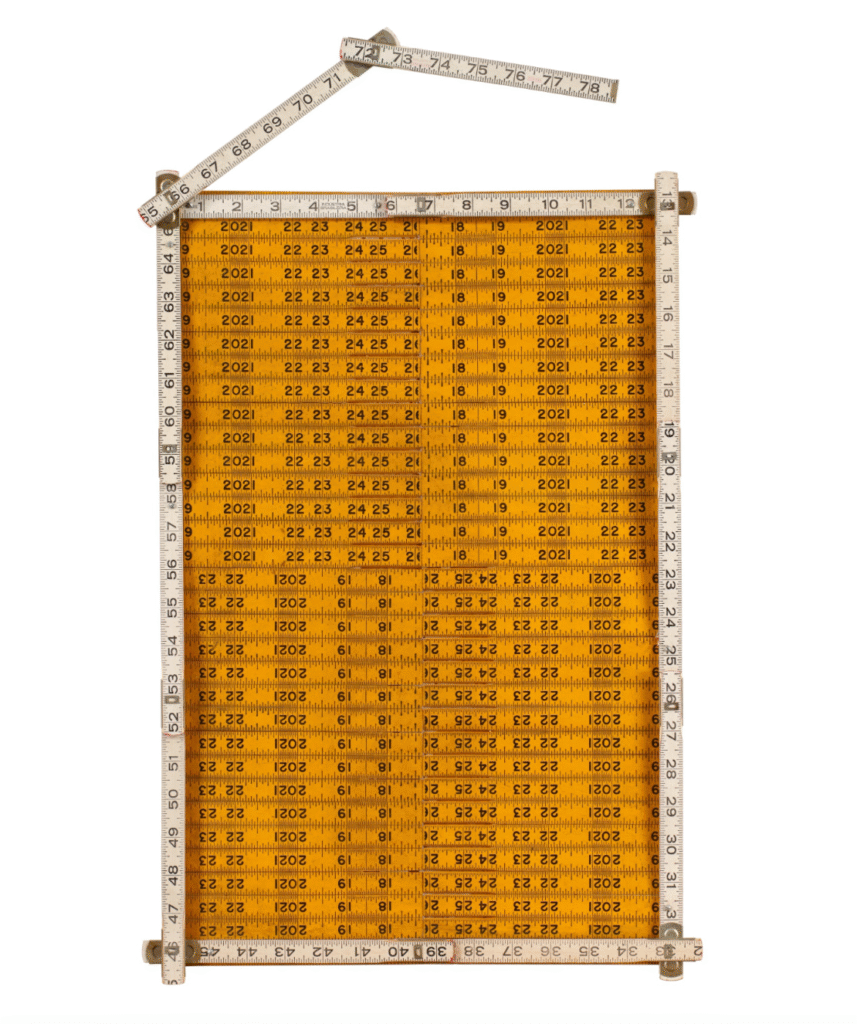

In contrast, conceptual Brazilian art lots delivered softer results. Cildo Meireles, Metros; Jac Leirner and Sandra Cinto, Vôo II, all selling below their low estimates. Together, these results suggest a more selective demand for conceptual and contemporary works when compared to the enduring strength of Brazil’s constructive and optical legacy.

The withdrawal of Lygia Clark’s Bicho, 1962 before the auction points to a recurring pattern at Sotheby’s, where another Bicho, a 1960 sculpture, was similarly pulled from the May 2024 sale.

This recurring pattern is highly troubling for the artist’s market. Withdrawals of this kind create uncertainty because it becomes unclear whether the impediment stems from the work provenance, authenticity or from a strategic decision by the consignor. In either case, the effect is the same: the removal introduces opacity, undermines bidder confidence, and generates insecurity among collectors of Clark’s work. Rather than an isolated hiccup, these repeated withdrawals cast a shadow over her market visibility and complicate the broader institutional consolidation of modern Brazilian art.

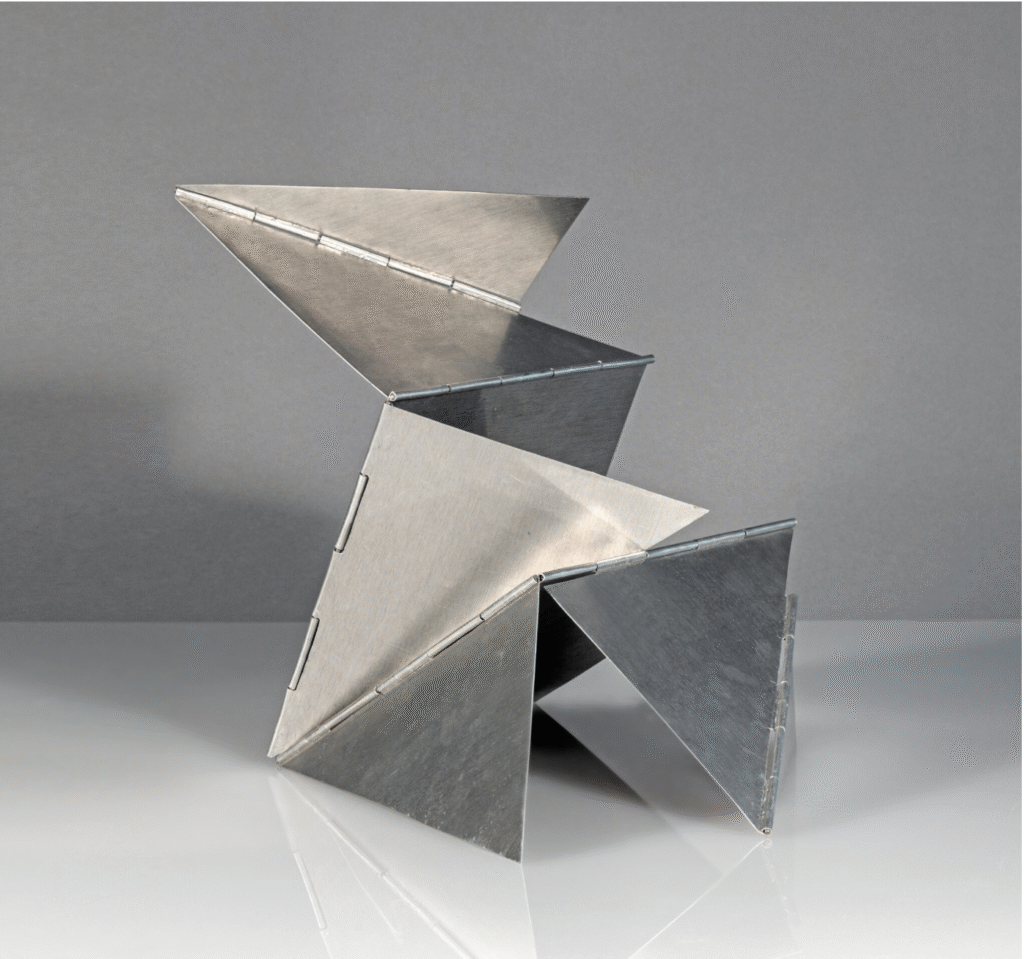

Lygia Clark

Bicho, 1962

Aluminum

40 x 40 x 35 cm

Estimate: $350.000 – $450.000

This lot has been withdrawn

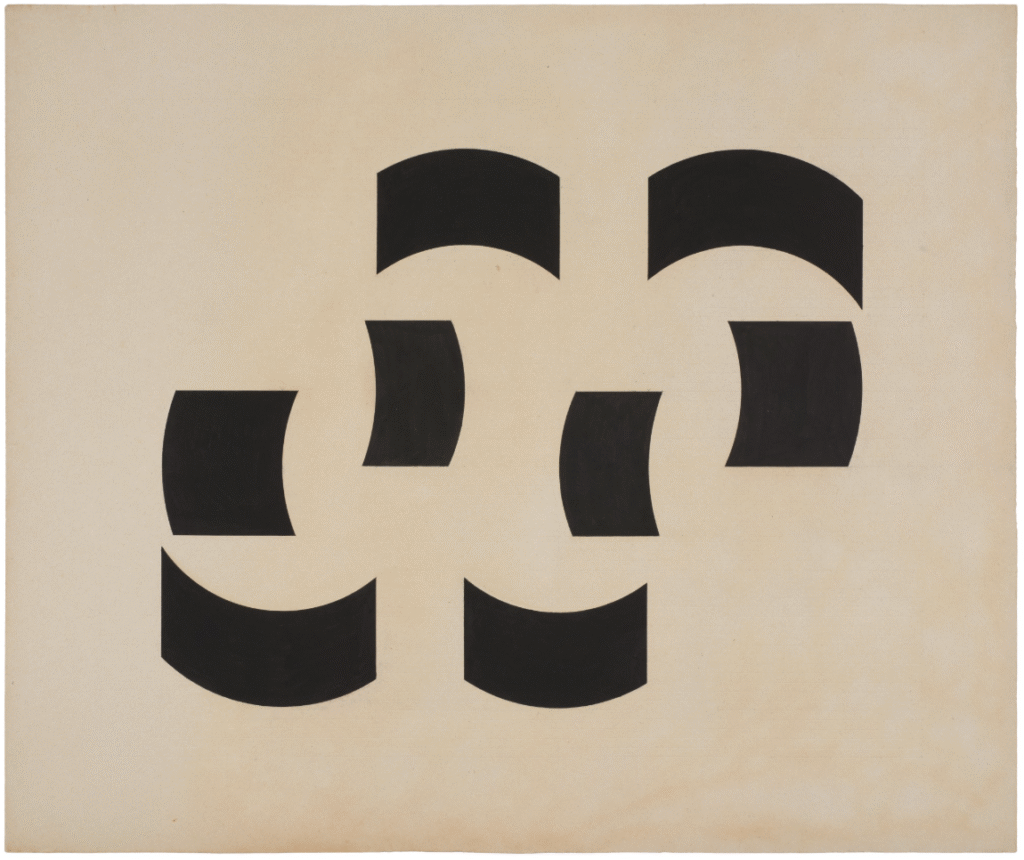

Abraham Palatnik

Progressão HO-A, 1965

Jacaranda veneer on panel

102.2 by 89.2 cm.

signed, titled and dated 65 (on the reverse)

Estimate: $50.000 – $70.000

Sold: $88.900

Cildo Meireles

Metros I, 1977-92

Acrylic and rulers laid down on canvas

51.8 x 34.9 cm

Estimate: $70.000 – $90.000

Sold: $63.500

Sandra Cinto

Vôo II (Flight II), 2022

Acrylic on canvas

165 by 220 cm.

Estimate: $70.000 – $90.000

Sold: $63.500

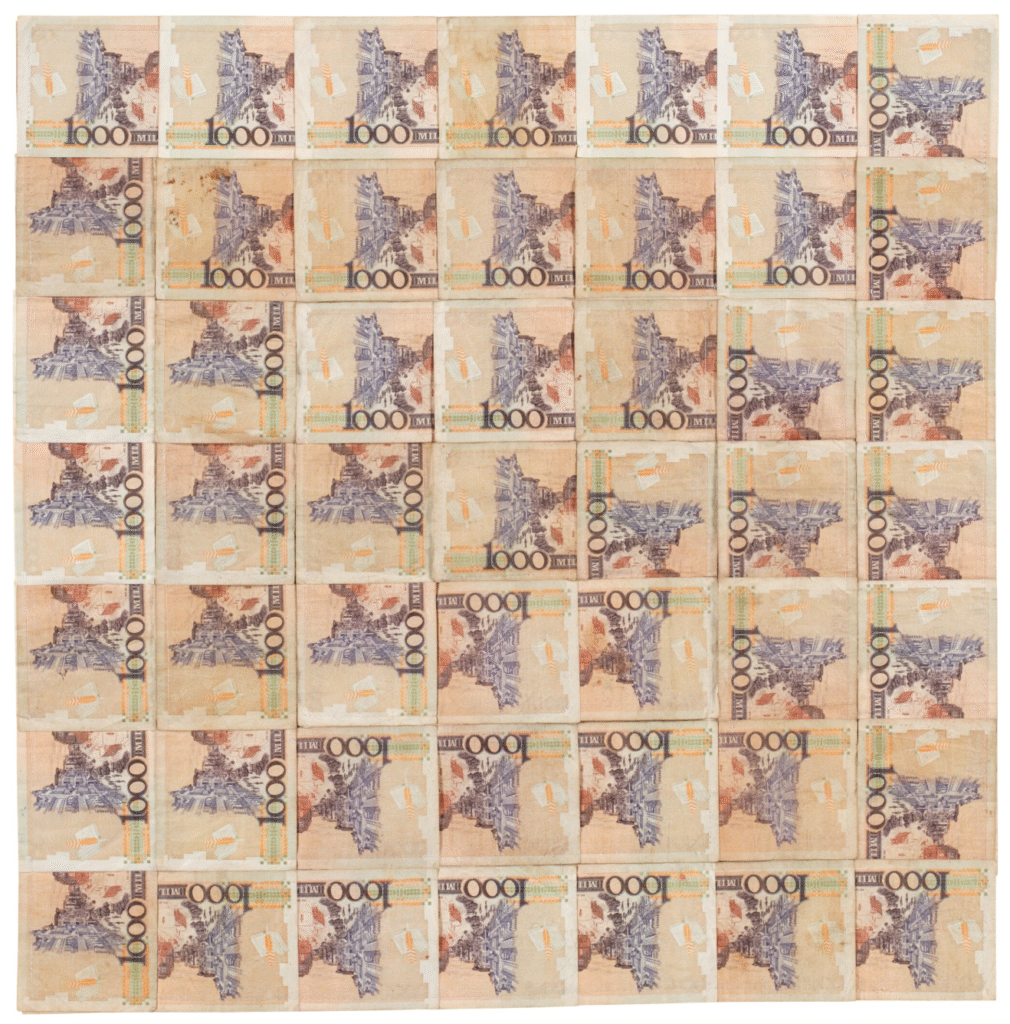

Jac Leirner

Fora dos Cem, 1992

Stitched Brazilian real collage on fabric

50.8 x 50.8 cm

Estimate: $25.000 – $35.000

Sold: $22.860

Modern Evening Auction

20 November 2025 | 19:30 EST

While 2025 confirmed the strong performance of Brazilian contemporary art, the historical segment faced a more complex and revealing situation. Both Brazilian masterpieces offered at Sotheby’s Modern Evening, a major work by Cândido Portinari and a rare sculpture by Maria Martins, were withdrawn before reaching the auction floor. In Portinari’s case, this issue reflects a structural market reality: high-value historical works are primarily pursued by established Brazilian collectors inside Brazil, who are already familiar with these masterpieces through the local market. When there is no expectation of competitive international bidding, most often due to prohibitive import taxation, consignors frequently withdraw their lots to avoid depreciation, safeguarding the artwork’s value rather than risking a silent sale.

In contrast, the withdrawal of Maria Martins, an artist of growing institutional weight, remains unexplained, and precisely for that reason, it highlights a structural weakness in the international circulation of Brazilian historical art. When museum-level works fail to reach the market, uncertainty emerges: is the issue logistical, documentary, or a lack of liquidity? Whatever the reason, repeated withdrawals create a perception of instability and reveal the vulnerability of historical Brazilian art in global auctions. This fragility is aggravated by a nearly 50% import tax in Brazil, which discourages transactions and repatriation of masterpieces, limiting international competitiveness and creating a paradox: the more significant a Brazilian modernist work becomes, the harder it is to circulate, sell, or even display in a transparent market ecosystem.

Maria Martins

O Guerreiro, 1940

Painted iron

200 cm

Estimate: $700.000 – $1.000.000

This lot has been withdrawn

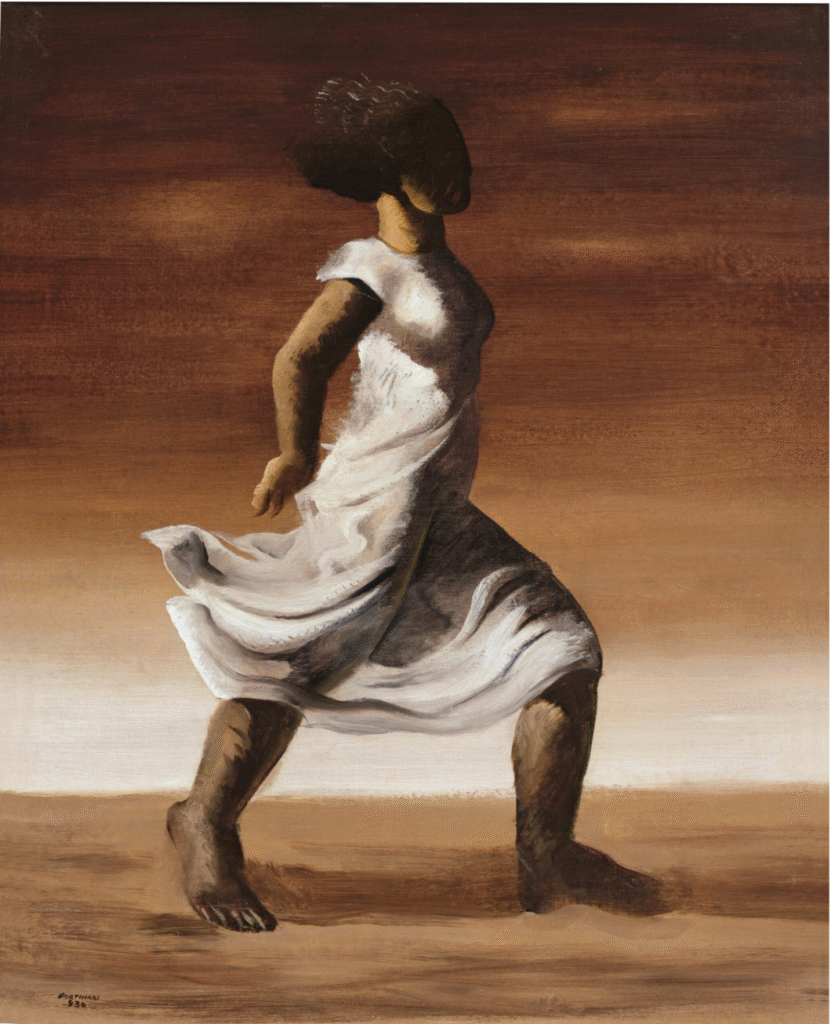

Candido Portinari

Mulata de vestido branco, 1936

Oil on canvas

73 x 60 cm

Estimate: $800.000 – $1.200.000

This lot has been withdrawn

Modern Day Auction

21 November 2025 | 10:30 EST

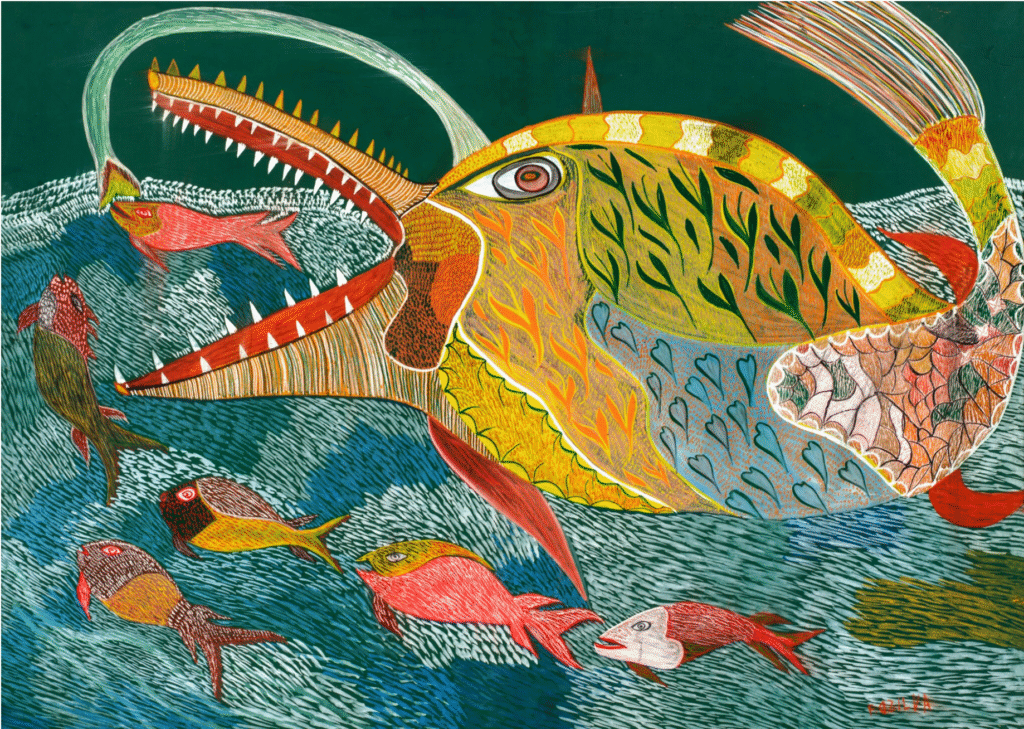

In Sotheby’s Modern Day Auction, Chico da Silva delivered one of the session’s most surprising outcomes. Jungle Hunter, 1963, a historical gouache on board estimated at just $18.000–$22.000, reached $53.340, more than tripling expectations. This result cannot be read merely as price escalation: Chico da Silva holds a historic place in Brazilian art as the first Indigenous artist to represent Brazil at the Venice Biennale, in 1966, and works from the 1960s painted on board, such as the one offered, belong to his most sought-after period. His market has recently gained international traction following institutional visibility across major fairs, including Frieze London 2024 (Galeria Galatea) and Independent New York 2024, reinforcing curatorial interest in Amazonian narrative, myth and cosmology.

However, while the auction result may suggest momentum, it should also be approached with nuance. Chico’s local market values remain significantly lower, and pricing jumps can reflect a speculative phase, especially when driven by rare masterpieces entering the secondary market. A precedent helps illustrate this shift: Serpente da Serra Luminosa, c.1966, sold at Sotheby’s New York in November 2023 for $330.200 (with premium), a landmark record for the artist. In light of these milestone results, Jungle Hunter confirms not only rising global interest, but also a market still searching for equilibrium between institutional recognition and pricing sustainability.

By contrast, Emiliano di Cavalcanti demonstrated stable, predictable liquidity. His painting Paisagem do Bahia, 1965 sold for $88.900, slightly above its low estimate, reinforcing the consistent market performance of a canonized modernist, while Chico’s surge signals a faster and more transformative moment for previously marginalized artists.

Emiliano Di Cavalcanti

Paisagem do Bahia, 1965

Oil on canvas

53.4 x 72.7 cm

Estimate: $70.000 – $90.000

Sold: $88.900

Chico da Silva

Jungle Hunter, 1963

Tempera on cardboard mounted on panel

52 x 72 cm

Estimate: $18.000 – $22.000

Sold: $53.340

Christies

Post-War & Contemporary Art Day Sale

20 November 2025 | 10:00 & 12:00 EST

Christie’s presented a striking contrast this season when compared to its May auction. While the spring sale featured a curated selection of 13 Brazilian artists, including historically significant names such as Lygia Pape, Mira Schendel and Lygia Clark, November reduced the country’s presence to a single lot. The shift suggests a strategic retreat from the Historical Brazilian Artists.

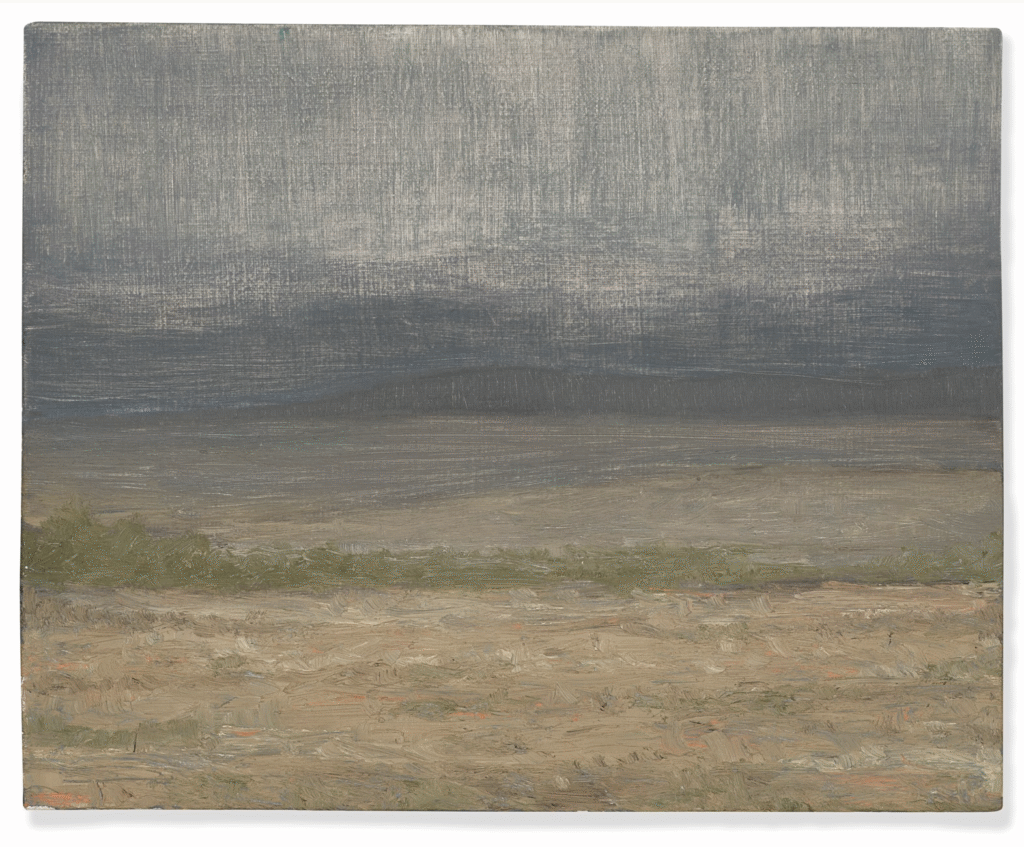

Within this reduced context, Lucas Arruda nonetheless reaffirmed his liquidity in a striking way. His 2011 painting, neither a canonical “Seascape” (the most sought-after typology in his oeuvre) nor a particularly remarkable example of his practice, achieved $317.500, more than tripling its average estimate, a price bracket typically reserved for his strongest and most recent works.

The result highlights a market dynamic in which demand is driven less by the individual qualities of a given piece and more by Arruda’s symbolic positioning, pointing to a collector base willing to sustain top-tier valuations even for works outside his most coveted series. In other words, what sold here was not simply a painting, but the assurance of his market status within a consolidated institutional and commercial ecosystem, one notably reinforced by David Zwirner, one of the world’s most influential contemporary galleries, which has been intensifying its advocacy of the artist following his recent exhibition at the Musée d’Orsay in Paris.

Lucas Arruda

Untitled 8, 2011

Oil on canvas

24.1 x 30.1 cm

Estimate: $70.000 – $100.000

Sold: $317.500

Phillips

Modern & Contemporary Art Day Sale, Morning Session

21 November 2025 | 10:00 EST

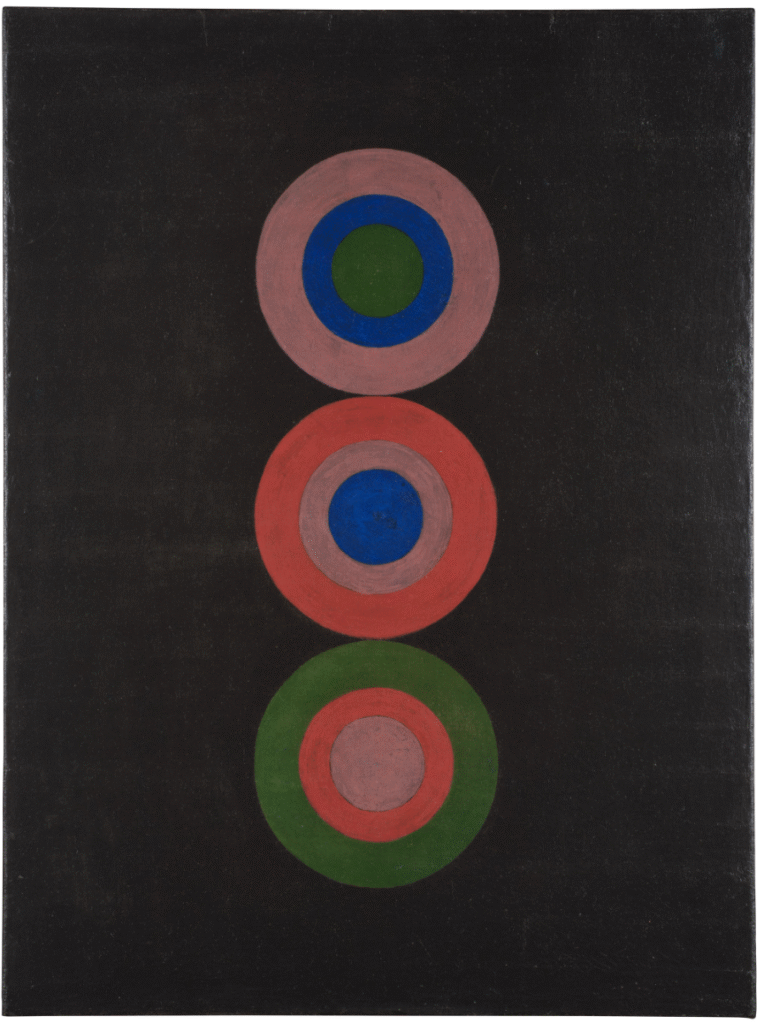

Phillips’ decision to position Brazilian works alongside key post-war figures created contextual value rather than isolation. By integrating Constructivist and Neo-Concrete legacies into an international narrative, the Morning Session reinforced that these works thrive when treated as part of global post-war abstraction, a curatorial approach that builds collector confidence for historically important, mid-scale pieces backed by strong archival and museum relevance. Hélio Oiticica and Judith Lauand both achieved results comfortably above estimate ranges, not because of speculative pressure, but because they were offered at mid-market, historically grounded price levels. In Lauand’s case, the valuation was particularly attractive for a 1963 work, making the final result not a surprise outlier, but a confirmation of demand when high-quality Neo-Concrete works are presented with realistic pricing.

Hélio Oiticica

Metaesquema no. 69, 1958

Gouache on cardboard

45.1 x 53.7 cm

Estimate: $50.000 – $70.000

Sold: $70.950

Judith Lauand

Untitled, 1963

Oil on canvas

64.1 x 47.9 cm

Estimate: $18.000 – $25.000

Sold: $58.050

It is also notable that a work by Rubem Valentim was withdrawn due to authenticity concerns, serving as a reminder of the ongoing need for rigorous provenance verification and specialist consulting when handling Brazilian modernist paintings a highly local and specific field that requires expertise from specialists who simply do not exist within international auction houses.

Rubem Valentim

Emblema, 1985

Oil on canvas

50.2 x 35.2 cm

Estimate: $20.000 – $30.000

This lot has been withdrawn

Modern & Contemporary Art Day Sale, Afternoon Session

21 November 2025 | 14:00 EST

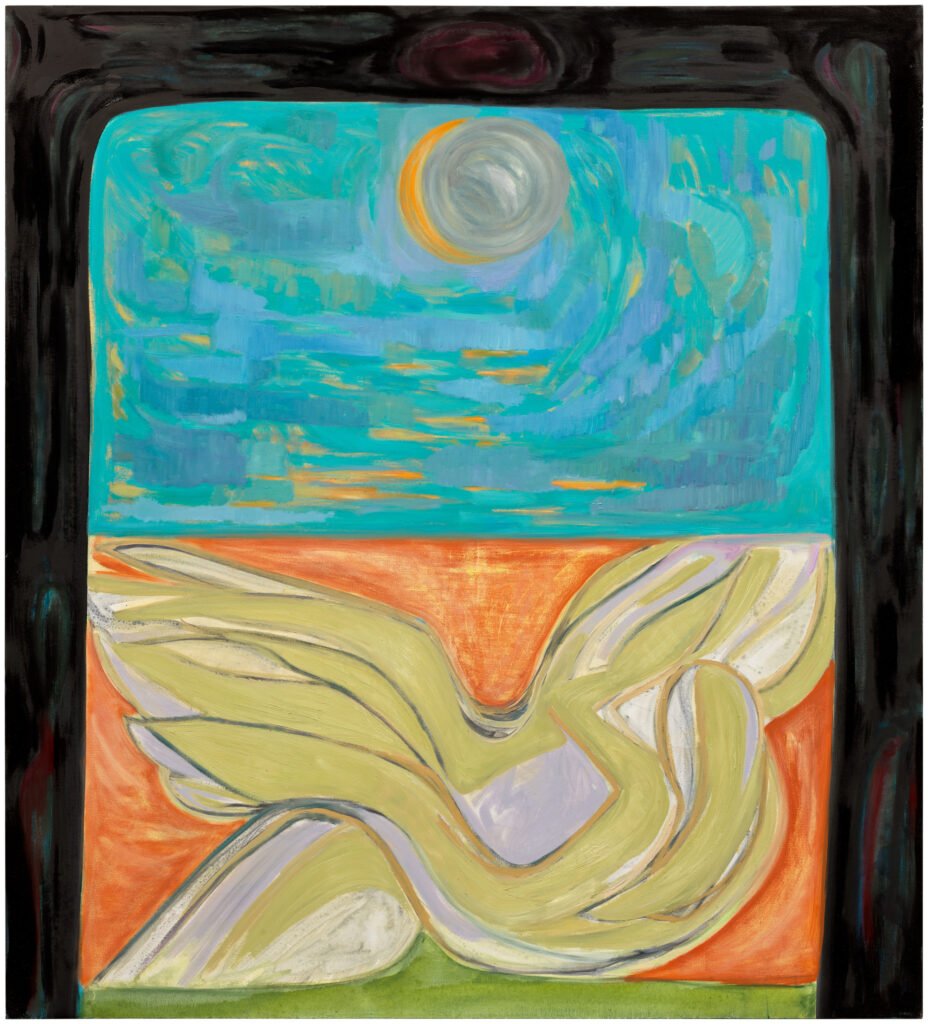

In the Afternoon Session, Phillips reinforced its curatorial positioning with strong demand for Brazilian contemporary painting. Marina Perez Simão, who is jointly represented by Pace Gallery (New York/Los Angeles), stood out with a robust result that aligned with her growing institutional visibility and collector appeal. Her most recent solo exhibitions Solanaceae at Pace Los Angeles (Jan 20–Mar 2 2024) and a ongoing show at Pace Tokyo (Nov 4 2025–Feb 11 2026) underscore her global resonance.

A second oil painting by the artist, originally announced for the sale, ultimately became unavailable for undisclosed reasons. The withdrawal highlights the increasing competition for high-quality recent works and the careful circulation control exercised by galleries and consignors. Rather than a setback, it indicates a market dynamic in which scarcity itself becomes a strategic lever, consolidating value and reinforcing Simão’s position as a Brazilian artist of growing international investment interest.

Marina Perez Simão

Untitled, 2022

Oil on linen

246 x 200 cm

Estimate: $120.000 – $180.000

Sold: $167.700

Marina Perez Simão

Untitled, 2020

Oil on canvas

170.2 x 153.7 cm

Estimate: $80.000 – $120.000

Lot removed

Brazilian Participation in Numbers

The Fall 2025 auction season reinforces a decisive shift in how the international liquidity of Brazilian art is defined abroad. The most relevant outcomes did not arise from volume, but from high-impact, institutionally positioned works that continue to attract competition among seasoned collectors. Artists such as Antonio Obá, Lucas Arruda and Marina Perez Simão confirm that global interest is anchored in living voices, while the outstanding performance of Chico da Silva signals a broader cultural realignment. The entry of Afro-Brazilian and Amazonian narratives into mainstream collecting is not anecdotal, but symptomatic of a market increasingly attuned to geopolitical revision and under-represented modernities.

In contrast, the historical segment exposes a structural challenge. Whether due to scarcity, provenance rigor, logistical constraints or strategic withdrawals by consignors, these barriers prevent more robust representation of artists who, paradoxically, enjoy strong institutional prestige. Rather than a market setback, this reflects a lack of infrastructure for the international circulation of masterpieces, a gap that continues to limit the global consolidation of Brazilian modernism and its historical production.

This imbalance is not only visible abroad. In Brazil itself, the market’s attention increasingly gravitates toward contemporary figures, with modernist artists losing visibility commercially. The public explosion of contemporary demanddynamic, speculative and rapidly valorized, raises an uncomfortable question: how long can a market sustain intense growth when it turns away from its own historical foundations? When history is overlooked in favor of accelerated speculation, it reveals not a natural evolution but the fragility of a system still lacking structure, regulation and long-term cultural stewardship.