ô

THE GLOBAL ULTRA-CONTEMPORARY ART AUCTION MARKET

Despite a 38% decline in global turnover compared to the same period in 2022, which reached a remarkable $206 million, H1 2023 stands as the third-best semester in the history of the Ultra-contemporary art segment. There is a noticeable stabilization in this market after the dynamic post-Covid period.

Over the course of 23 years, the segmentãs turnover has grown exponentially, experiencing an 8.5-fold increase from $14.9 million in H1 2000.

The emergence of new talent is a key characteristic of the Ultra-Contemporary scene, with a staggering 2.646 artists under the age of 40 taking part in at least one auction during the first semester of 2023.ô Discover the top 20 Ultra-Contemporary artists by auction turnover in H1 2023!

*Our newsletter features information from the Artprice Contemporary Art Market Report.

Top 20 Ultra-Contemporary Artists (born after 1980) by Auction Turnover (H1 2023).ô ôˋartprice.com

Despiteô Matthew Wongô (1984-2019) being the most expensive Ultra-Contemporary artist in the market, his half-year turnover ofô $14.116.706experienced a decrease of just over $5 million compare to last year, due to the limited availability of his works at auction.ô

In H1 2023, five of his paintings were sold, compared to eight in H1 2022. In April 2023 Matthew Wongãsô River at Dusk, fetched a record price ofô $6.66 Millionô at Sothebyãs Hong Kong (50th Anniversary Contemporary Evening Auction). Last year,ô The Night Watcherô (2018) was sold forô $5.897.150ô at Sotheby’s, New York; andô Green roomô (2017) went forô $5.340.000ô at Christie’s, New York.ô

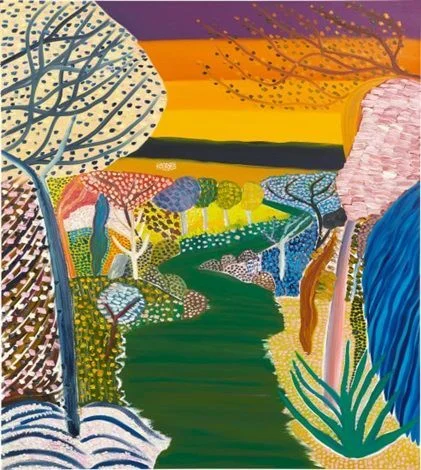

Matthew Wong was a self-taught Canadian contemporary painter. Battling with Tourette’s syndrome and depression, he found early critical acclaim for painting vibrant, mesmerising landscapes and still life with a subtle melancholic undercurrent.

ô

ô

Matthew Wong, River at Dusk, 2018.

ô

ô

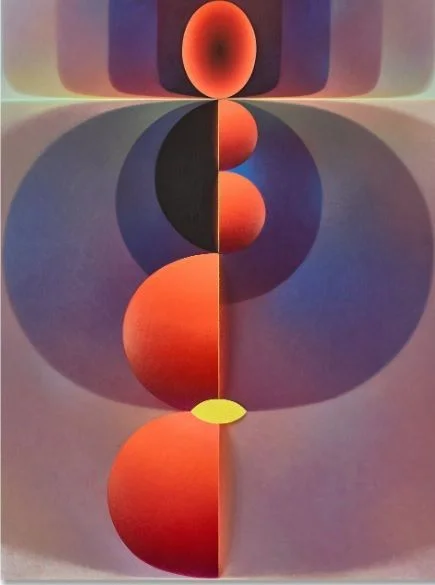

In third place, following the Canadian artist specialized in NFTô Dmitri Cherniak, is American artistô Loie Hollowellô (b.1983) with a turnover ofô $5.756.267.ô

Represented by theô Paceô gallery since 2017, her work’s prices have consistently risen, culminating in a new record ofô $2.29 millionô forô Standing in Redô at Sothebyãs Hong Kong. In the first half of 2023, all seven of her canvases sold at auction met or exceeded their pre-sale estimates.ô

Fourth in the ranking of Ultra-Contemporary artists by sales for the period, it was in November 2023 thatô Jadûˋ Fadojutimiô (b. 1993) shone brightest. In fact, three of her works beat the previous record set in 2021.ô Quirk my mannerismô realized overô $1.9 million, tripling the low estimate, at Phillips New York.ô ô

She is the youngest artist with work,ô I Present Your Royal Highness, in the collection of Tate Modern, London. Currently, her work is exhibited in ãSpace for Imaginative Actionsã at Kunstmuseum Bonn, and at the Shah Garg Foundation (New York) in ãMaking Their Markã. The abstract painter has become one of the most sought-after emerging artists, even joining Gagosian last year.

Avery Singerô (b.1987), who impressed at the New York sales in May 2022 withô Happeningô (2014) sold forô $5.253.000ô by Sotheby’s, ranks 5th. In May 2023, a 2016 painting went forô $4.063.451ô at Christie’s Hong Kong.ô

Avery Singer is known for her large-scale airbrush paintings created from digitally generated visuals. Utilizing the 3D architectural modelling softwareô SketchUpô as her main tool, Singer produces canvases that seamlessly merge conceptualism and abstraction, showcasing a distinct avant-garde sensibility.

The seventh-best-selling artist is the Polish painters,ô Ewa Juszkiewiczô (b. 1984), who often confronts stereotypical perceptions of womenãs beauty in classical European painting. She is represented by Gagosian and Almine Rech. Her auction record was established in 2022, withô Portrait of a Lady (After Louis Leopold Boilly)ô sold forô $1.5 million, well above its $300.000 high estimate at Christieãs New York.

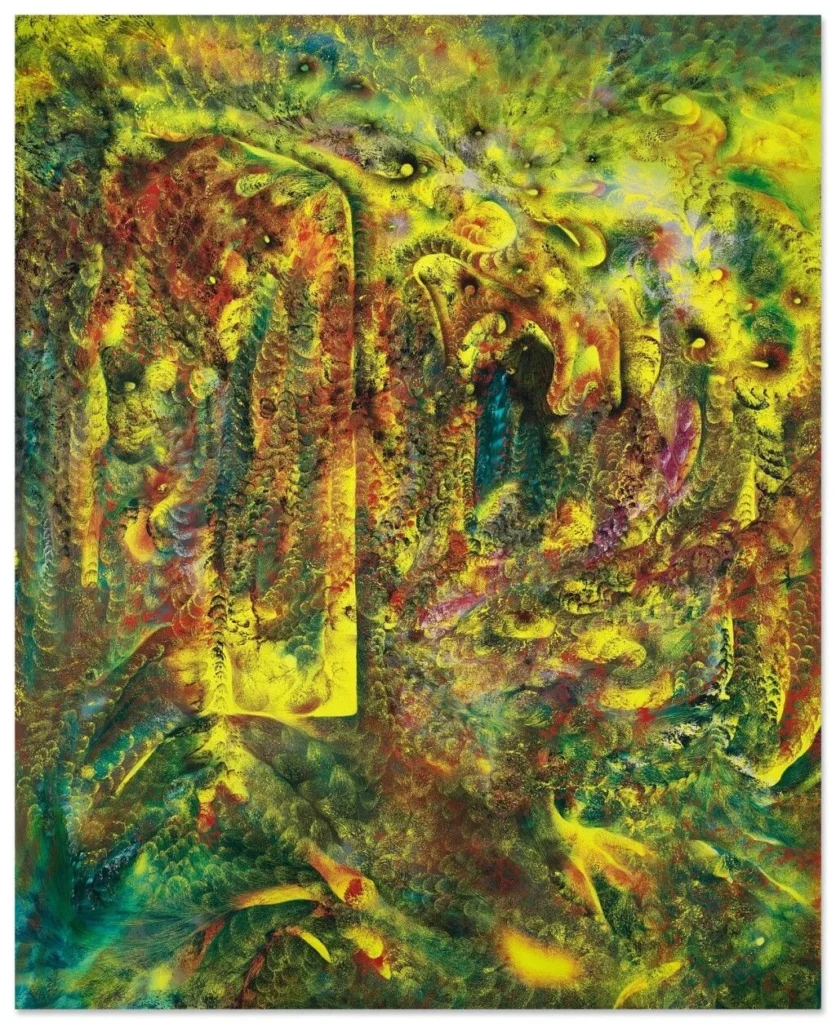

The Chinese artist,ô Liang Haoô (b. 1983), represented by Gagosian, stands out in this year’s ranking. He set a new auction record in April 2023 withô Theology and Evolution,ô sold forô $3.140.164ô at Sotheby’s Hong Kong.

Blending the Chineseô gongbiô technique with the scientific rationalism found in Western painting, Hao Liang incorporates elements from both ancient and contemporary Chinese and Western philosophies. Through his art, he seeks to rationalize the connection between the physical world and the cycles of life and death.ô

ô

ô

Liang Hao,ô Theology and Evolution, 2011.

ô

Lucy Bullô (b.1990), ranked 9th in the Top 10 Ultra-contemporary ranking, tripled her turnover from the previous year! Represented by David Kordansky Gallery, set an auction record in October 2023, withô Flash Chamberô reachingô $1.757.138, at Sotheby’s Hong Kong.ô

The contemporary artist based in Los Angeles is known for her dreamlike paintings.ã This year, Bullãs work was exhibited at The Warehouse (Dallas), in ãLucy Bull: Nacarã, and she had a solo exhibition at the Long Museum Shanghai.

Leading a movement of emerging black abstract artists,ô Michaela Yearwood-Danô (b.1994), ranked 11th, is attracting bidders. Based in London and represented by Marianne Boesky Gallery, she set a record at Christieãs in late February, withô Love me notsô (2021) achieving a remarkable result ofô $884.000ãover ten times the high estimate.

In her paintings, the British artist Michaela refers to her Caribbean identity and reflects on themes of social and personal identity, love, and loss.ô

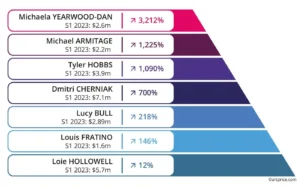

Auction turnover has exhibited significant increases for certain Ultra-Contemporary artists in the first half of 2023, compared to the corresponding period in 2022. Notable figures includeô Michaela Yearwood-Dan,ô Michael Armitage, digital artistsô Dmitri Cherniakô andô Tyler Hobbs, along withô Louis Fratino,ô Lucy Bull, andô Loie Hollowell.

Compared to H1 2022.ô ôˋartnet.com

In H1 2023,ô Michael Armitage, represented by both David Zwirner and White Cube, ranked 14th and achieved a new auction record exceedingô $2.2 millionô for his paintingô Muliro Gardens (baboons)ô at Sothebyãs in London.ô

In 2018, the MET acquired one of his canvases. He participated in the 58th Venice Biennale in 2019 and had an exhibition at the MoMA titled ãProjects 110: Michael Armitageã; while his canvasô The Conservationistsô (2015) surpassed Sothebyãs New Yorkãs estimate by 25 times, selling forô $1.52 million. Since then, he has seen a rise in visibility and reputation.

Michael Armitage,ô Muliro Gardens (baboons), 2016.

The Brooklyn-based painterô Louis Fratinoô (b. 1993), ranked 19th, is known for his intimate portrayals of queer desire and a sense of familiar comfort in his figurative portraits. Drawing inspiration from Cubism and Fauvism, his paintings frequently embrace the styles and palettes reminiscent of early 20th-century modernists.ô

Represented by Sikkema Jenkins & Co, Louis Fratino’s auction record was set in February 2022 withô The Argumentô (2021) which went forô $730.800ô at Sotheby’s New York.ô

Flora Yukhnevichô andô Christina Quarlesô secured positions in the Top 10 rankings last year, but their auction turnovers this year experienced an 80% decline. This year they rank 17th and 24th respectively. Despite the substantial decrease a few months after their impressive records were set, the market’s moderation appears beneficial. In the past year, their works were rarely available at auction, and all pieces were sold. Therefore, the situation is more indicative of market regulation rather than a lack of interest in their artworks.

Top 10 Ultra-Contemporary works sold at auction (H1 2023).ô

ôˋartprice.com

ô

Brazilianô Lucas Arrudaô (b. 1983) comes 39th in the ranking, with a turnover ofô $699.842ô over the period. He joined David Zwirner in 2018, and his work is included in the collections of the Fondation Beyeler, Basel; J. Paul Getty Museum, Los Angeles; Pinacoteca do Estado de SûÈo Paulo; and the Rubell Museum, Miami.ô

He is known for his evocative landscapes, more a product of a state of mind than depictions of particular locales, that blur the boundaries between mnemonic and imaginative registers.ô

The Rubell Collection has been including works by Ultra-Contemporary artists for a few years now, such as two paintings by Luca Arruda in 2015.

Oil on canvas, 30 x 38 cm.

Acquired in 2015 by the Rubell Museum Miami.

The Contemporary art market witnessed an exceptional growth in 2021 and 2022, marked by unprecedented results following the easing of Covid-related restrictions. The scarcity of offerings in this segment has led to a 22% decrease in transactions involving 7or 8-digit sums. Theô overall sales turnover in Contemporary artô has experienced aô 15% decline compared to the previous year, reflecting an anticipated adjustment following the post-pandemic frenzy.ô

Despite this, the period set a historical record for the volume of Contemporary artworks exchanged at auction, with over 123.000 works changing hands. While multi-million-dollar transactions dominate, representing a micro-market for the elite, the lower end of the market (works under $5.000) is experiencing significant growth, constituting 80% of the global transaction volume.ô

Collectors are actively seeking works by new artists, with theô Ultra-Contemporary segmentô witnessingô a 30% increase in transactions compared to the pre-Covid period. Bidders remain highly active for works valued under $50.000, and, while avoiding bidding wars at higher price levels.

In the realm of Ultra-Contemporary art, the past year has underscored the prominence of women artists, a trend increasingly visible in museums, fairs, galleries, and the media. ô Similarly, Black art, representing the creative expressions of African or African diaspora artists, continues to take a leading role in this dynamic sector.ô

Embracing inclusivity, the Ultra-Contemporary art market reflects a growing commitment from collectors, museums, and galleries to champion the diversity of artists historically underrepresented in the art world. Notably, artworks addressing socio-political issues are gaining traction at auctions, with collectors seeking pieces that are socially engaged, shedding light on inequalities, injustices, or bringing forth underrepresented narratives, further enriching the evolving landscape of the art market.

Collectors are actively seeking works by new artists, with theô Ultra-Contemporary segmentô witnessingô a 30% increase in transactions compared to the pre-Covid period. Bidders remain highly active for works valued under $50.000, and, while avoiding bidding wars at higher price levels.

The Ultra-Contemporary art market is faster than the other markets, causing trends to evolve rapidly, as seen in auction results. Today, the Ultra Contemporary market can sometimes offer higher profits for investors and speculators compared to secondary market artists on a buy-sell basis.

The marketãs gains are exponential. However, they are also a trend initiated by mega-galleries, in collaboration with museum curators and their wealthy clients, who sustain the market, but for how much longer?

This is a complete system that effectively introduces artists to the art market while ensuring their value will not fall. The sector is exclusive, involving just a few actors, resulting in artworks that are almost unattainable for the average person. Waiting lists for purchasing artwork can be extremely long, sometimes endless. Certain galleries prioritize collectors who have made previous purchases, and in certain instances, donating a painting to a museum may be required to acquire a new piece.

The Ultra-Contemporary market fad leads to speculative buying, which can be detrimental to the long-term careers of young artistsãÎ.

ô

ô

ô

ô