Significant transformations are underway in the auction house landscape, promising substantial impacts on the Art Market in both the short and long term. A pivotal adjustment comes from Sotheby’s, announcing a reduction in the Buyer’s Premium from 26% to 20% on any hammer price up to $6M, plus 10% on any portion of the hammer price above that amount. This change, initially announced on February 1st, is slated to be officially implemented on May 20, 2024 and will certainly impact the results of the New York sales that SSAA will attend. Register our newsletter to receive the sales results.

The Buyer Premium is the commission paid by the buyer to the auctioneer and was created 45 years ago. These changes aim to attract more bids, remain competitive with their counterparts and encourage new customers accustomed to purchasing in private sales to transition to auction. Sebastian Fahey, Sotheby’s managing director of global fine art says that they believe that a simplified fee structure will bring more participants to the market, simply by making transacting easier to understand. Masterpieces artworks are becoming increasingly rare on the market, prompting auction houses to offer their sellers the most favorable conditions possible, sometimes even exempting them from commission fees, as they can still generate revenue through buyer commissions.

Sotheby’s London Sold The Collection Of Dutch Banker William Weinberg In July 1957.

Historically, auctions hold significance in society, providing an opportunity to network. But according to recent research, an auction business is in gradual decline. A forthcoming report from the auction-results database Artprice shows that, although the total number of works of art at auction reached a record high in 2023, the value generated by these sales was slightly down, including at the top end. There were 1,550 sales of more than $1M last year, compared with 1,682 in 2022 and 1,762 in 2021. Indeed, capturing a successful auction involves a slow process to curate an engaging catalog. The auction tool may not be inherently suited for a market where sellers seek quicker liquidity. This is why auction houses have also ventured into the private sales market, which now constitutes a crucial strategic focus and is estimated to represent between 30 to 50% of their revenue.

Other initiative to address the problem of fast liquidity is the example of Fair Warning founded by Loic Gouzer, formerly of Christie’s. On average, he selects one piece per week to auction on the app. His expenses must be sufficiently low to enable him to offer a competitive buyer’s premium, which, at 15%, is significantly lower than the rates charged by major auction houses.

Since 2010, the demand from clients for direct sales has become more significant. The market dynamics have changed so much over the past twenty years. It has become highly globalized, and the roles of each of its participants have evolved, blurring the lines between the dealer, the gallery owner, and the auctioneer.

Concerned about navigating these changes in the art market? Gain confidence in your investment decisions by joining our free masterclass on how to start investing in art. Learn actionable strategies to capitalize on market shifts and build a successful art portfolio today!

Private Sales : Confidentiality and Discretion

Due to their position and the transactions they handle, auction house collaborators have an enhanced knowledge of where certain pieces can be located. By finding the artwork sought by a buying client among the assets of a potential selling client, they save collectors a significant amount of time while further fostering loyalty through the quality and speed of the service provided. On top of it most private art sales transactions are kept secret, given that buyers usually want to maintain privacy. Behind the scenes of the art market, some of the most intriguing discoveries of treasures and high-value sales occur.

In this context, it is known that Sotheby’s has played a crucial role in facilitating various sales for institutions. Additionally, in the past few years, its private sales operations have exceeded $1 billion, representing roughly 20% of its total auction earnings. In the year 2019, precisely half of the aforementioned $1 billion originated solely from 30 works of art.

These include the private sale of a valuable 16th-century Parmigianino painting known as Virgin With Child, St. John the Baptist, and Mary Magdalene, along with Bernini’s remarkable bust of Pope Paul V, for the J. Paul Getty Museum in Los Angeles, and a magnificent 14th-century Illuminated Hebrew Bible for the Metropolitan Museum of Art.

Parmigianino (Francesco Mazzola)

Virgin With Child, St. John the Baptist, and Mary Magdalene, 1535–1540

Oil on paper, laid down on panel

75 x 59 x 3 cm

In today’s world, people’s attention spans are increasingly shorter, and auction houses are now able to satisfy their clients without them having to wait for the next public auction.

Another positive argument is that each private sale involves a unique, individually negotiated agreement, providing increased control over pricing. In contrast to auctions where the starting point is low and increases, private sales usually commence at a higher point and reach a middle ground.

The confidentiality and discretion of private sales are also sought-after advantages by a growing number of clients. Some individuals prefer not to disclose how much they paid for an artwork or simply dislike exposing themselves during public auctions.

For sellers, private transactions are appealing as they significantly reduce certain risks. In a public auction, there’s always the possibility that the lot may not reach the expected price. In such a case, not only does the item remain unsold, but it also becomes ‘burned.’ Everyone can know that the object went unsold, making it undesirable and challenging to sell later. In a private sale, this risk doesn’t exist since the sale result is not made public.

Interested in exploring the benefits of private art transactions? Our art advisory service facilitates seamless buy and sell transactions, ensuring discretion and maximizing value for both buyers and sellers. Contact us today to learn more about our exclusive private sales opportunities.

Commission Cuts: Unleashing Waves Of Change In The Art Market

Seller commissions vary internationally, typically ranging from 0% to 20%, contingent on the artwork value that the seller consigns to the auction house.

Buyer commissions, known as buyer premiums, are regulated and cannot be lowered. They typically range from 20 to 30% and vary in tiers based on the hammer price.

All commissions are deducted from the hammer price. For a buyer, the total cost of the artwork must, therefore, take into account the buyer premium, often the price listed on auction results sites as it represents the actual cost of the piece.

Picasso’s Femme assise sur une chaise displayed as part of the

Frieze Week exhibition at Sotheby’s in 2015 in London, England.

It’s a move that aims to enter a very profitable market, according to the latest Art Basel and UBS Market Report released last year. Combining all sales of auction houses (both private and public), the auction sector accounted for 45% of the value of sales in 2022, down by 2% in share year-on-year, while dealers and galleries were at 55% (including all online and offline retail sales of art and antiques in the primary and secondary markets).

This is a move that is a big concern for major gallerists. The same report presents a survey stating that 75% of major galleries are concerned with auction houses. The main reason is the blurring of boundaries between dealers and auction houses in terms of sales, such as auction houses conducting a higher portion of private sales (a concern for 70% of the sub-sample), and auction houses engaging in primary market sales (52%).

Art Basel in Miami Beach 2022. Courtesy of Art Basel.

This is the case for instance of Philips which is getting closer to contemporary artists and working directly with them, as demonstrated by the launch of the platform Dropshop, which aims to make exclusive works of art and collectibles commissioned directly from contemporary artists available to collectors. This strategic positioning aligns with Philips’ ongoing specialization in the 21st-century art market and the new trend in the artists’ market is to be increasingly independent and free from the galleries.

Clearly, the distinction between the functions of galleries and auction houses is becoming increasingly blurred, leading to occasional conflicts of interest. This is illustrated by the recent accusation made by The Korean Galleries Association against major auction houses in South Korea. The association alleges that these auction houses have breached a 2007 agreement by directly consigning artwork, including pieces by well-known artists such as Park Su-guen, Lee Ufan, and Kim Tschang-yeul. Despite previous appeals, the auction houses have persisted with these practices, upsetting the balance between primary and secondary art markets, stunting the growth of emerging artists, and fueling speculation within the market. A survey conducted by the association found that 70% of its members have either experienced or heard of damage caused by these auction-related activities.

So, we need to consider how the long-term reduction of the buyer’s premium can impact both the primary and secondary markets, as well as buyers’ behavior regarding their preference between purchasing from galleries or auction houses as well as on seller expectations. The reduction will still affect types of art that perform well at auctions, as lower prices may attract buyers to other market segments. This can increase competition between buyers, increase prices and create potential profits for sellers.

If other auction houses follow suit to remain competitive we will see a broader industry shift in pricing structures in addition to market expansion and new demands for art.

Let’s note that all auction houses have yet adjusted their buyer premiums. For example, Bonhams and Christie’s still maintain high rates.

Christie’s Impressionist and Modern Art Evening Sale, May 2019 in New York.

Brazil Situation and Adjustments

It’s worth mentioning that in Brazil, there’s an interesting reversal in the amounts of buyer and seller commissions compared to international norms. Typically, sellers bear the burden of commissions, paying between 10 to 20%, while buyers only incur a 5% auctioneer’s fee. In response to this impactful change announcement, our company conducted a survey among major Brazilian auction houses to understand the strategies being implemented to confront competition and adapt to the pace of a new global market.

Let’s take note that in recent years, certain Brazilian auction houses have begun to raise their buyer premiums in order to provide more advantageous terms to their buyers while simultaneously lowering seller commissions. This suggests a flexible commission strategy, where the auction house adjusted its fees for sellers, possibly as a means to attract more sellers and increase the volume of artwork available for sale. This reduction in sellers seems to have brought benefits, such as attracting new clients or facilitating the acquisition of artworks.

Brazilian logic also favors the reduction of seller commissions, as they believe sellers are in need of money, whereas buyers, being in the position of purchasing, do not need money and thus do not require a reduction in their commission. Despite some of them wanting to align with the international market by increasing buyer commissions, they emphasize that this is proving to be a challenge, especially in markets where this practice is not common and may not be well-received initially.

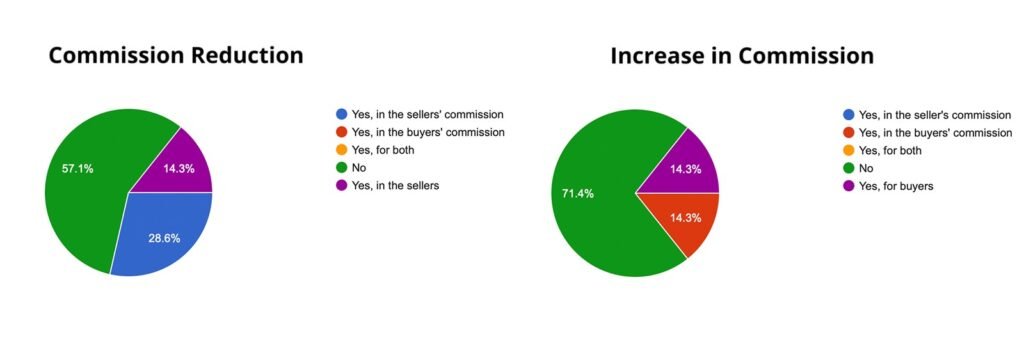

SSAA Survey Results from Brazilian Auction Houses.

To develop their market and rise head in front competitors, the main points addressed by Brazilian auction houses are as follows: Large-scale logistics, digital investment, and finally diversification of market niches to stand out from the competition and maintain excellence in hiring globally qualified specialists. Thus, we understand that according to the directors of auction houses in Brazil, the competence of an auction house is judged by the scale of its business, its investments in IT, as well as the renown of its professionals and their global reputation. The strategies employed by auction houses to foster customer loyalty include offering the highest quality curation of artworks, maintaining personalized contact with collectors, and delivering excellence in customer service.

Auction houses must brace themselves to trim their margins while simultaneously investing in productivity and efficiency. Remaining competitive nowadays poses a significant challenge without evolving into market giants. Regrettably, smaller auction houses find it increasingly difficult to withstand the emergence of mega conglomerates. The suggested remedy involves reducing margins while boosting investment in larger business models, aiming to yield proportional profits. However, in the long term, this strategy presents a formidable gamble for market players lacking substantial initial capital.

However, we expect some auction houses to adopt a wait-and-see attitude by monitoring the impact of Sotheby’s action on market dynamics, buyer behavior and their own financial performance before deciding on a response.

Companies that supply products to high-end collectors may even be less inclined to reduce buyer premiums if they feel that doing so may harm their brand image or perceived value, thus lowering their prices to serve their customers’ interests.

As the art market undergoes transformations, it’s crucial to equip yourself with the knowledge and skills needed to thrive. Ready to take the first step towards art investment? Enroll now in our complimentary masterclass on art investment strategies!